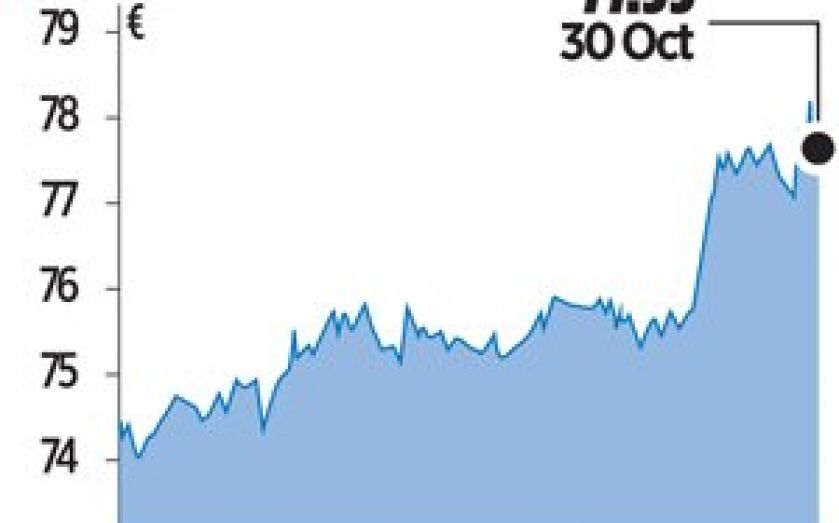

Sanofi lowers annual outlook after vaccine hit

FRENCH drugmaker Sanofi has lowered its 2013 profit guidance for a second time after a slowdown in China, weaker generic sales in Brazil and manufacturing problems at a Toronto vaccine plant dented third-quarter results.

Sanofi said it now expected full-year earnings per share around 10 per cent lower than in 2012 at constant exchange rates, having previously signalled a seven to ten per cent drop.

However, chief executive Chris Viehbacher told reporters that the problems encountered during the quarter were largely one-offs that the company had now put behind it.

“We’re confident about being able to get back to growth in the fourth quarter,” he said.

Anderson said Sanofi’s performance in emerging markets, and particularly in China, was clearly on the weak side, mirroring problems faced by other drug companies in the quarter.

A crackdown on big pharma firms’ sales practices in China, increased government pressure on drug prices from Asia to Latin America, and weakness in emerging market currencies are acting as a reminder that growth in those regions remains volatile.

Worldwide, Sanofi’s sales fell 6.7 per cent to €8.432bn (£7.22bn) in the third quarter, generating earnings per share of €1.35, down 19 per cent.

Business net income, which excludes items such as amortisation and legal costs, declined 18.7 per cent to €1.789bn.

Generic drug sales were down 5.4 per cent due to the lingering impact of inventory issues in Brazil in the previous quarter.