Revealed: June’s top and bottom performing funds

June was dominated by trade war fears as Donald Trump said he would add further tariffs on Chinese and European goods should there be any retaliation to his initial tranche of measures. The prospect of mercantilist trade policies unnerved investors concerned about future growth. There are few, if any, real winners in a full-blown trade war. An escalation is likely to result in job losses, corporate profit erosion, higher consumer costs and equity market losses.

The trajectory of the dispute remains unclear, but there are hopes the US administration will not want to cause too much of a sell-off in markets ahead of the midterm elections, which are due to be held in November. Indeed, one major issue in the debate has been the transfer of technology from US to Chinese companies through corporate takeovers and business partnerships, but President Trump decided against a broad-based crackdown. Instead he opted to work with Congress on a more modest measure that involves letting the Committee on Foreign Investment in the United States deal with concerns about foreign purchases of sensitive domestic technologies. Markets took this as a positive sign.

Chinese stocks have, so far, been hit the hardest by the escalating trade tensions and specialist funds investing in the country were among the weakest performers during the month. The sell-off in equities also affected broader emerging market and Asian funds as well as those in the European and Japanese equity sectors.

Relatively few equity funds were able to produce significantly positive returns, although UK smaller companies and the North American sectors were stand out areas. A rise in the dollar to a one-year high in the last week of June favoured investment denominated in the US currency. This was negative for US exporters, but the small-cap Russell 2000 hit a new record as domestic-focused equities tend to outperform in a period of dollar strength.

The technology sector was also able to buck the largely negative trend for global equities, albeit with significant volatility. Amazon, for instance, made gains, partially at the expense of other sectors, as rumours emerged that the e-commerce titan is to move into the insurance sector. The tech giant also agreed to buy PillPack, an online pharmacy, news that sent shares in US listed pharmacies lower.

The Federal Reserve hiked US interest rates during the month from 1.75 % to 2%, citing solid economic expansion and employment gains. It’s the seventh time that the US central bank has raised rates since 2015 as it moves towards monetary policy normalisation. The hike itself was no surprise but tweaks to the Fed’s ‘forward guidance’ provoked more of a stir with the overall language used seen to indicate the pace of rate rises could accelerate.

In contrast to the hawkish tone from the Fed, the European Central Bank (ECB) said it did not expect to raise interest rates before the end of summer 2019. Bond markets were therefore mixed with yields rising and prices falling in the US but proving more stable in Europe. Property and infrastructure funds were, however, notably strong.

Although investors should be aware past performance is not a reliable indicator of future results, here are the top and bottom ten Investment Association funds and sectors for June 2018 in full:

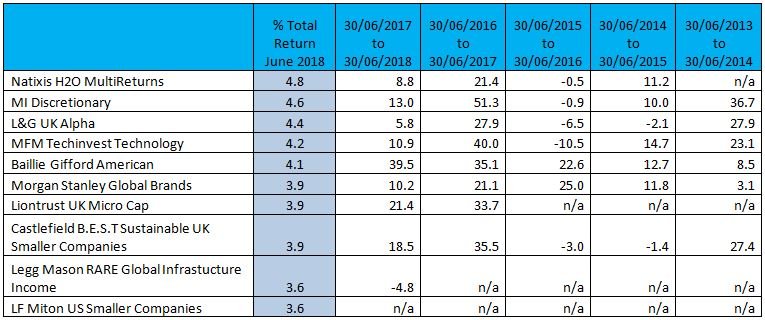

Top 10 funds:

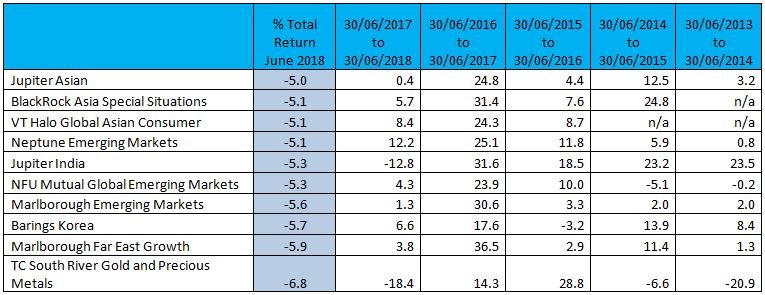

Bottom 10 funds:

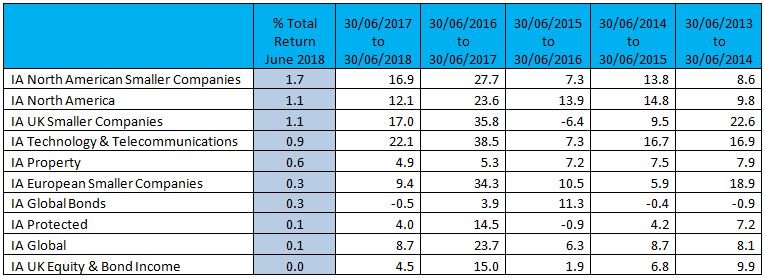

Top 10 sectors:

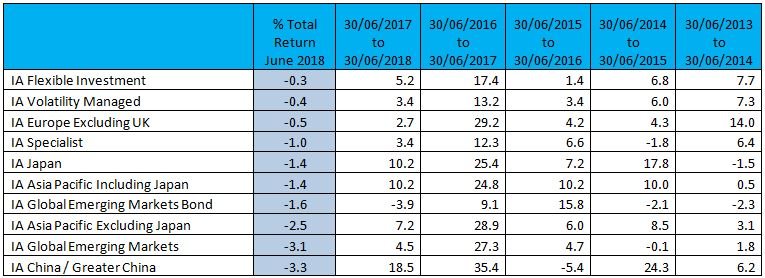

Bottom 10 sectors:

Past performance is not a reliable indicator of future returns. Figures are shown on a % total return basis, bid to bid price with net income reinvested; Source: FE Analytics, data for June 2018: 31/05/2018 to 30/06/2018. Onshore and retail open-ended funds only.

This website is not personal advice based on your circumstances. No news or research item is a personal recommendation to deal. Investors should be aware that past performance is not a reliable indicator of future results and that the price of shares and other investments, and the income derived from them, may fall as well as rise and the amount realised may be less than the original sum invested. Investment decisions in collectives should only be made after reading the Key Investor Information Document or Key Information Document, Supplementary Information Document and/or Prospectus. If you are unsure of the suitability of your investment please seek professional advice.