PMIs: UK economy slips hard in August as recession warning lights flash

The UK economy has contracted significantly this month according to a closely-watched index.

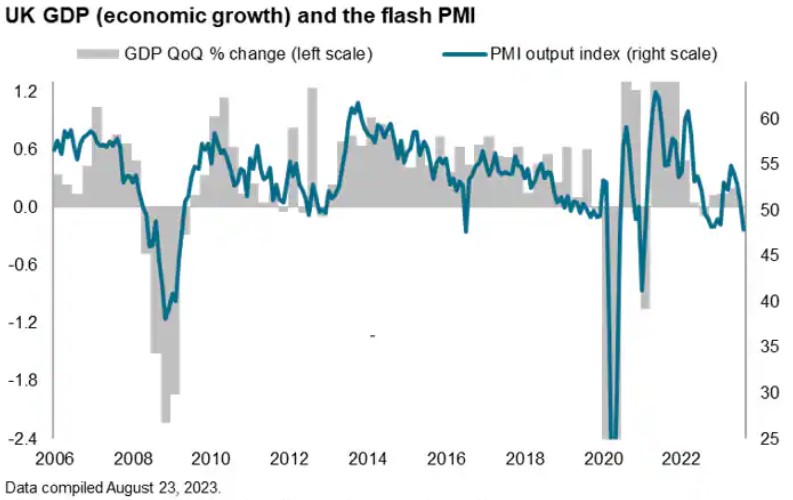

S&P Global’s Purchasing Managers’ Index (PMI) for the UK economy came in at 47.9 – far below the 50 reading which indicates flat growth. The PMI assesses the health of an economy’s services and manufacturing sector.

Analysts had predicted a reading of 50.3 this month.

The all important services sector slipped from 51.5 last month, indicating expansion, to a seven month low of 48.7. Manufacturing meanwhile continued to fall, slumping to a 39-month low of 42.5.

The slowdown in growth will please some in the Bank of England, who are attempting to take the heat out of the UK economy and bring down persistently high inflation.

Many companies recoded a reluctance among clients to spend due to higher interest rates and stretched disposable incomes. Looking forward, service providers also flagged concerns that higher rates would continue to dent consumer spending.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said “the fight against inflation is carrying a heavy cost in terms of heightened recession risks.

“A renewed contraction of the economy already looks inevitable, as an increasingly severe manufacturing downturn is accompanied by a further faltering of the service sector’s spring revival. The survey is indicative of GDP declining by 0.2 per cent over the third quarter so far,” he said.

The survey also suggested that inflationary pressures continued to moderate in August, with input costs rising at the slowest pace for two and a half years.

However, businesses also reported that wage pressures were persistently strong.

Although the data points to a slowdown in private sector activity, most analysts expect the Bank to send rates higher at its next meeting in September, bringing the rate to 5.5 per cent.

Gabriella Dickens, senior UK economist at Pantheon Macroeconomics, said that the Bank’s rate setters “likely will not be willing to take any risks with the inflation outlook and probably won’t have seen enough hard evidence by their meeting next month to press the stop button”.

Nevertheless, falling activity and the moderate rise in input costs suggests that the Bank is nearing the end of its rate hiking cycle.

Martin Beck, chief economic advisor to the EY Item Club, said September’s probably rate hike “will likely be the last in the current cycle”.

The decline in the UK followed a poor performance in the Eurozone, where private sector activity slumped further into contraction.

At 47.0, the gauge of activity was comfortably below the 50-no change mark and was the lowest level since November 2020. Excluding the pandemic it was the worst performance since April 2013.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said: “The service sector of the eurozone is unfortunately showing signs of turning down to match the poor performance of manufacturing.

“Indeed, service companies reported shrinking activity for the first time since the end of last year, while output in manufacturing dropped again,” de la Rubia continued.