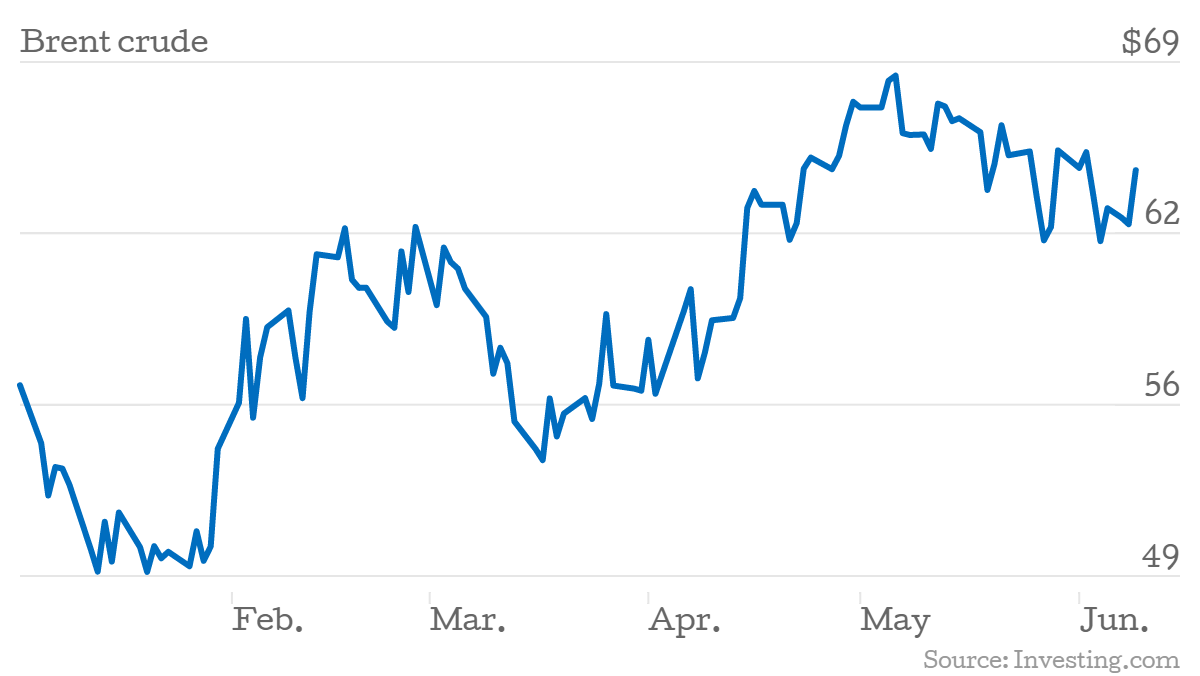

Oil prices jump again as US forecasts fall in shale oil production

The price of Brent crude rose more than 3.6 per cent to close to $65 per barrel this afternoon, after a forecast from the US Energy Information Authority suggested supply from the US' shale gas sector is likely to dip over summer.

Meanwhile, West Texas Intermediate rose three per cent to $59.90, suggesting US oil investors were equally relieved at the EIA's drilling productivity report, which suggested oil production in the top seven shale producing regions in the country will fall 91,000 barrels a day in July, to 5.5m barrels.

The abundance of shale oil has been one of the largest contributors to falling oil prices in recent months, as investors hedged against too much supply. Meanwhile, Middle Eastern cartel Opec has played chicken with the figures, insisting on sticking to current production levels of 30m barrels per day.

The overall effect has been falling prices: Brent Crude may have risen in recent days, but its price is still 41 per cent lower than it was a year ago.

"The resilience in oil prices continue to surprise," admitted Michael Hewson, chief market analyst at CMC Capital Markets.

"Expectations of another draw in oil inventories, as stockpiles fall on the back of lower rig counts, is helping underpin prices.