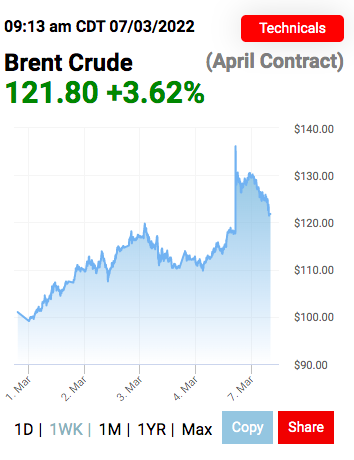

Oil hits 14-year highs and closes in on $130 per barrel amid fears of tightening supplies

Oil prices soared to $130 per barrel earlier this morning – its highest level since 2008 – amid fears of tightening supplues, with the US and Europe weighing up a Russian oil import ban.

Brent Crude jumped 9.2 per cent, peaking at $128.99, before dropping later in the session to around $125, while WTI Crude also rose 8.5 per cent – hitting $125.48.

Meanwhile, Monday’s intraday highs are near record levels seen for both contracts in July 2008, when Brent Crude hit $147.50 a barrel and WTI touched $147.27.

Sokoil is currently trading at a whopping $27 discount to Brent Crude, however there are increasingly few takers for its supplies.

US Secretary of State Anthony Blinken revealed yesterday the West is exploring banning imports of Russian oil, having previously exempted commodities from its list of sanctions following the country’s invasion of Ukraine.

The White House is now coordinating with key Congressional committees towards a US-specific restrictions on Russian imports.

Global oil prices have spiked more than 60 per cent since the start of 2022, along with other commodities, raising concerns about world economic growth and stagflation.

China, the world’s second largest economy, is already targeting a slower growth of 5.5 per cent this year.

Fears of $200 prices loom large in oil industry

Investment bank Stifel has warned that oil prices could balloon to a staggering $200 per barrel if global markets cut off Russian oil supplies entirely.

This prediction has been echoed at Bank of America, which have forecasted that a five million barrel shortfall if most of Russia’s oil exports are cut off.

The IEA has proposed a 10 point plan to reduce Europe’s reliance on Russia – suggesting the continent could cut down its Russian commodities reliance by a third by pursuing agreements with other countries.

However Chris Wheaton, investment analyst at Stifel outlined that Russia supplies 7.5m barrels per day to world markets.

Replacing that would require the West to use up all of the global spare oil production capacity, alongside the return of more Iranian oil in the market, a ramp up in drilling in the US shale industry, and demand destruction from high prices, to offset the heavy losses of Kremlin-backed commodities.

Eccentric billionaire Elon Musk has called for oil and gas output to be boosted across developed markets to mitigate the escalating disruption.

Taking to Twitter, he said: ““Hate to say it, but we need to increase oil & gas output immediately. Extraordinary times demand extraordinary measures.”

Goldman Sachs was more bullish on US capabilities, expecting the country to source heavier crude slates to offset the impact.

The investment bank was also more sceptical over how much disruptions additional sanctions would have on the markets.

In an investment note, Goldman Sachs said: “While the headline of potential further US sanctions are likely to support prices, such a move would likely have negligible impacts on global crude and products markets. The US only imports a little over 400,000 barrel per da from Russia at present (Dec-Feb average), already down from a peak of 770,000 barrels per day in May-Jun 2021. Volumes this small are well within the market’s ability to redirect flows and as such we would expect minimal overall impact on crude fundamentals.”

However, while the US could manage the situation, moves to exclude Russia from global markets would be especially painful for Europe, which relies on the country for a third of its imports.

Commerzbank analyst Carsten Fritsch explained: “According to the US Energy Information Administration, the US imported 20.4m barrels of crude oil and oil products per month from Russia last year, which amounted to eight per cent of US liquid fuel imports. Europe’s dependence is noticeably higher, with Russian crude oil accounting for roughly a third of total imports. What is more, the EU also buys diesel from Russia, which explains the strong response of the Brent and gasoil markets.”

OPEC+ and Iran could struggle to provide relief

Alongside escalating conflict in Ukraine, and the subsequent ramping up of sanctions, OPEC+ has consistently missed its raised output targets.

While it remains committed to raising supplies by 400,000 barrels per day, multiple members have failed to hit production quotas since the start of the year.

Meanwhile, talks to revive Iran’s 2015 nuclear deal with world powers have become increasingly uncertain, following Russian demands for a US guarantee that sanctions it faces over the Ukraine conflict will not hurt its trade with Tehran.

Commerzbank was also sceptical over whether Iranian supplIes would provide more than short-term relief to markets.

Fritsch explained: “If US sanctions on Iranian oil exports were then to be lifted, this would pave the way for urgently needed oil from Iran. That said, this would not be nearly enough to offset an outage of Russian oil supplies. Iran could export up to 2.5 million barrels of crude oil per day, yet Russian crude oil exports total 4.6 million barrels per day.”

RBC Capital Markets believed commodity-related sanctions were inevitable and that investors should be pricing in a market devoid of Russian supplies.

Analyst Tyler Broda said: “The situation remains fluid. We think the market is moving to a de-facto ex-Russia commodity environment. Thermal coal, nickel, PGM’s and iron ore are the most impacted from our initial analysis albeit there are large potential impacts everywhere. Higher costs and demand destruction are likely to temper the outlook once supply levels are better understood.”