Exclusive: Energy crisis needs crisis measures argues Octopus chief executive Greg Jackson

The brutal collapse of nearly thirty suppliers over the past six months has driven Downing Street and Ofgem to desperate solutions.

Chancellor Rishi Sunak rolled out a whopping £9bn rebate scheme to protect households from spiralling costs, following the regulator’s painful decision to hike consumer bills this spring over 50 per cent – to an eye-watering £2,000 per year.

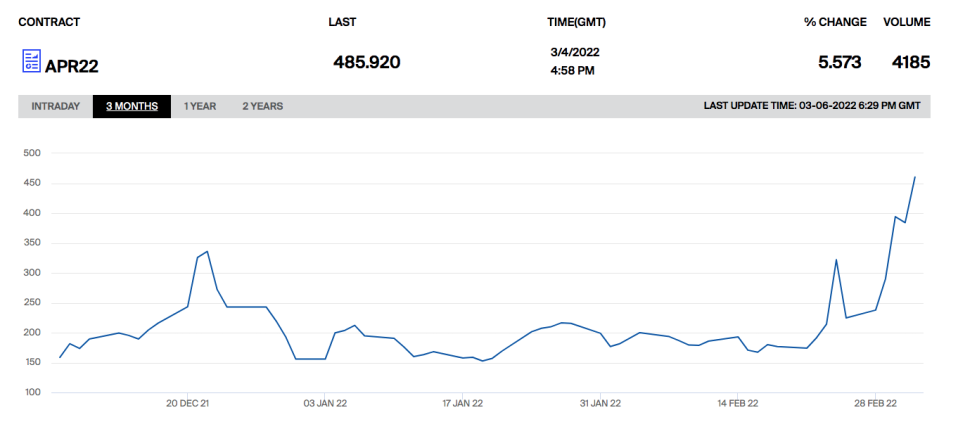

There are now raised fears Russia’s invasion of Ukraine could see the price cap spike again in October to £3,000 per year.

With continued debate over how to resolve the current crisis, Greg Jackson, chief executive at Octopus Energy, argues the leading model for the energy market has already been established in the UK, and can be taken off the shelf.

He told City A.M. the markets that serve consumers best are supermarkets.

Jackson explained: “In the case of supermarkets, you’ve got a relatively small number of companies totally focused on competing to drive down costs for customers to innovate, and to bring them new, better and cheaper products and services.”

When questioned over whether a tighter, smaller market would reduce consumer choice, he said this was preferable to the current setup, which peaked in 2018 with 80 suppliers.

Jackson compared the present day industry to walking through market day, with desperate vendors heckling questionably low prices to passers-by.

He said: “The energy market has been built with a completely false understanding of consumer choice. It resembled market stalls, with dozens of traders setting up at virtually no cost, piling it high and selling it cheap. Then, when the tough times came, packing up and disappearing.”

The Octopus boss considers insufficient hedging to be the primary cause of widespread instability in the energy market.

He argued industry challengers had to be comparable to Aldi and Lidl in the supermarket space, which arrived with a “new proposition” and a “new angle of competition” for the larger retailers.

Octopus calls for industry to fix long and short term issues

In many ways, Octopus is the Lidl or Aldi in the current energy market: the challenger shaking up an industry previously reliant on established names.

Founded in 2015, the renewables-only supplier has grown to over three million customers, and is now the fourth-biggest energy firm in the country.

While other companies have been holding tight in the crisis, Octopus has extended its tentacles across multiple European markets including Italy, Spain and France.

It has also scooped up all 580,000 customers from fallen firm Avro Energy, and Jackson did not rule out making a future bid for Bulb Energy’s 1.7m customers – which entered de-facto nationalisation last November.

He is now pushing for the industry to “work on short and long term problems at the same time”, with hedging controls and market reforms going hand-in-hand with an immediate ramp up in renewables and cutting down the UK’s reliance on natural gas.

Jackson said: “We need to treat the energy crisis with the same sense of urgency we did the Coronavirus crisis. The way that we deployed vaccines that normally take 15 years in one year, we need to deploy energy solutions at that pace now.”

The energy boss suggested suppliers need to give real advice on enhancing energy efficiency, rather than telling people to cuddle pets and do star jumps.

This includes meaningful tips on improving insulation and energy saving, which needed to be like the advice of a “personal trainer”.

It also meant another publicly funded package of support if the crisis worsens this winter.

Jackson said: “Energy has massive long term investments: nuclear has 25-year programmes. So, if we need to smooth this transition with support to customers that lasts for longer than five years, we should do so. But what we need to do is make sure that we’re not just kicking into long grass, we need to use the time we’re buying to fix the system.”