New EV charges threaten fragile consumer confidence

The UK government wants Britain to go electric, but carmakers are under strict sales targets, grants have been extended, and billions are being funnelled into infrastructure.

But at street level, the case for switching still depends on whether the switch will actually save drivers money.

That question has become sharper in recent weeks, with TfL ending London’s Cleaner Vehicle Discount, meaning EV drivers must pay the congestion charge.

Elsewhere, from April 2028, electric car owners will also face a new mileage-based road tax of around 3p per mile, confirmed in Reeves’ November Budget.

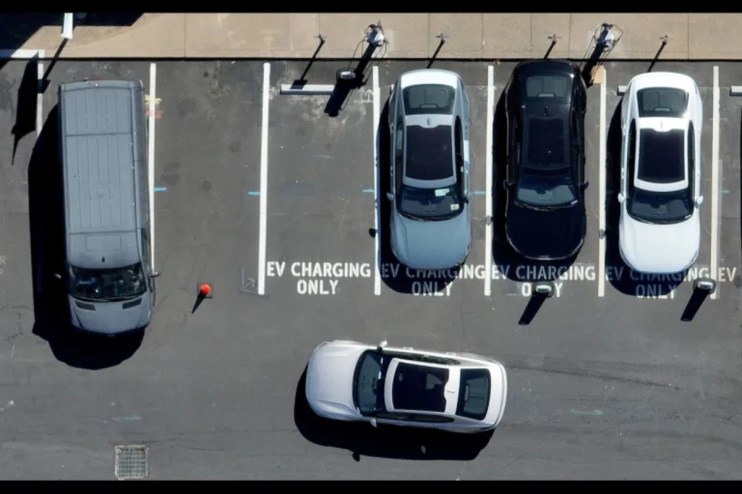

Business rates are also being applied to public charging for the first time.

Taken individually, each of these moves is defensible, but together they complicate the transition to electric.

Melanie Lane, chief executive of charging firm Pod, told City AM: “We are at the tipping point of going electric”.

“That shift to electrification is happening, but there is a lag in terms of consumer confidence for the mass market that I think we need to keep leaning into and addressing”.

For many buyers, that lag shows up in the research process before entering the EV market.

“If you listen to people who are buying EVs, they will talk about having spreadsheets, and they’ll talk about doing kind of complicated calculations to think about the charger, the car, but also the energy tariff, and how much its going to cost them”, Lane said.

She explained that the shift to EV should be made easy and affordable for customers to make them “feel like they’ve made the right choice”.

The cost question

The Treasury argues the new 3p-per-mile charge simply reduces fuel duty; electric drivers currently contribute nothing through petrol taxes.

At average mileage, that equates to roughly £255 a year. Petrol drivers, ministers have pointed out, already pay more.

Yet the charge lands as EVs accounted for 23.4 per cent of new car sales last year, below the 28 per cent ZEV mandate target.

The used market, which is vital for broadening access due to lower costs, remains balanced as fleet vehicles flow through and residual values continue to adjust.

“It’s about confidence”, Lane told City AM. “The more that we can do in the early stage of transition to just encourage and escalate adoption, the better the economics then work for everybody”.

That includes young drivers. Without a strong push within the second-hand market, Lane saysm the generation most supportive of green action risks being squeezed out of the EV market.

“It would be good if we could really lean in and help the next generation of drivers get to that position of electric driving much quicker”, she said.

Making it pay

Where the industry is pushing back is on running costs.

Charging overnight on off-peak tariffs already makes electric motoring significantly cheaper per mile than petrol.

Firms are increasingly trying to make these savings more visible to consumers.

Pod, for instance, has begun paying customers small cash rewards for allowing their home chargers to automatically shift charging to cheaper and lower-demand hours.

This essentially passes back revenue earned from helping balance the grid.

Trials have already returned over £330,000 to drivers, with further rollouts planned across the UK.

“Right now, I think affordability is what consumers care the most about”, Lane added.

The general direction of travel for the UK market remains positive, with the Zero Emission Vehicle mandate rising again this year, infrastructure continuing to expand, and grants remaining firmly in place.

But transitions like this are rarely linear, and if drivers feel incentives are being withdrawn faster than savings are being understood, hesitation will stump adoption.