Moonpig momentum dips following lockdown-induced spending boom

Moonpig’s revenue and profits have slipped as the lockdown-induced spending momentum dials down.

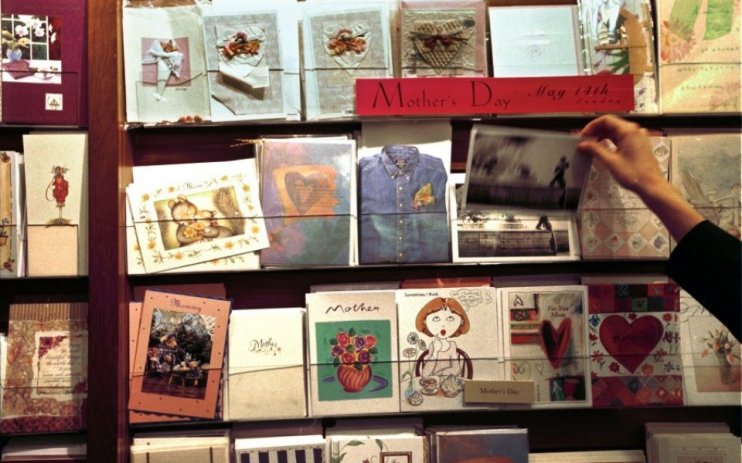

After shops reopened in the six months to October 31, Moonpig’s revenue has sunk 8.5 per cent to £142.6m, with it struggling to compete with the lure of brick and mortar card stores.

Investors were not deterred, however, with Moonpig’s share price jumping 6.5 per cent to 381.6p per share by early afternoon.

The card maker enjoyed a lockdown boom in 2020, with revenue more than doubling year on year, as the UK public turned to online avenues to source their birthday, anniversary and get-well-soon cards.

Moonpig also reported profit before tax dove more than 43 per cent in the six month period to £18.7m.

CEO at the Chartered Institute of Marketing, Chris Daly said: “Despite a strong start to the year, today’s results would suggest Moonpig has been losing out to competitors… The online card and gift retailer was hoping to reap the rewards of its huge marketing spend earlier in the year, but instead has found itself entering the festive season on the back foot.

“However, with concerns surrounding the new Covid variant growing, and consumers becoming more cautious and reluctant to head to physical stores, it may give Moonpig a much needed last minute sales boost.”

Despite the dip, the online card maker has capitalised on last year’s surge in spending, as it doubled down on its own app.

The app, which now accounts more over 40 per cent of the store’s orders, has helped drive orders to grow from 9.5min the same period last year, to 19.5m in the past six months.

CEO Nickyl Raithatha said in a statement: “Our new technology and data platform continues to make it easier for customers to remember, find, create and send the perfect greeting card and the perfect gift to their loved ones. As a result, our half year results demonstrated even stronger customer retention and our highest-ever proportion of revenue from gifting.

“The long-term opportunity remains vast, and we have never been in a better position to capture this growth.”