LME suspends nickel trading amid price boom

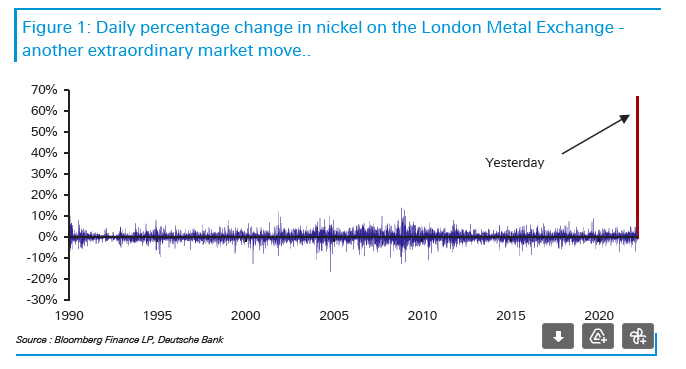

The London Metal Exchange (LME) has halted nickel trading for the rest of the day, after prices reached $100,000 per tonne for the first time ever, following a jump of more than 70 per cent on Monday.

LME has now introduced a series of emergency measures to allow traders to defer delivery obligations on all of its main contracts, including nickel.

The spike in prices was fuelled by panicked investors racing to cover short positions, after Western sanctions threatened supplies from major producer Russia.

While Indonesia remains the largest nickel producer, Russia is also a leading miner in the market, providing 10 per cent of the world’s nickel – escalating worries over potential shortfalls following the country’s invasion of Ukraine.

JP Morgan also noted Russia’s Nornickel is the world’s biggest supplier of battery- grade nickel: producing 15-20 per cent of global supply.

Three-month prices for nickel on the LME more than doubled on Tuesday to $101,365 a tonne, its biggest daily increase since it began trading on the market in 1987 and one of the extraordinary rises in the 145-year history of the LME.

Nickel is crucial for the construction of both stainless steel and electric vehicle batteries – with buyers scrambling to secure supplies ahead of a potential squeeze.

The LME is planning for the reopening of the nickel market, but has revealed it is considering a multi-day closure, given the geopolitical situation which underlies recent price moves.

In a statement, the exchange group said: “The LME has taken this decision on orderly market grounds.”

“The LME will actively plan for the reopening of the nickel market, and will announce the mechanics of this to the market as soon as possible.”

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown suggested huge volatility and rapid moves in price during trading in Asia prompted LME’s drastic decision.

She said:”It seems the meme stock frenzy has now metamorphosed into commodity chaos, as traders have scrambled to try and cover short positions. Those that had bet against the metal’s rise in value, have now been forced to buy at a much higher price, creating a short squeeze. It’s likely a big margin call prompted the suspension of trading, with sharp gains forcing speculators to scramble for additional capital to put into accounts to cover the shortfall.

Forecasting future price moves, Commerzbank analyst Daniel Briesemann had a more sceptical perspective of nickel movements.

He said: “We suspect that a so-called short squeeze is partly responsible for the extraordinary price surge, in addition to the concerns about supply. We regard the price surge as exaggerated and expect trading to calm down again once the short squeeze has run its course. The nickel price should then fall significantly again.”

Will Adams, head of battery and base metals research at Fastmarket suggested was reminiscent of the tin crisis in the 1980s.

He said: “Although no such suspension like this has happened since the tin crisis in 1985-86, the move in LME three-month prices to $100,000 per tonne, from Friday’s close at $29,130 per tonne, is likely to be a spike. With most of the buying pressure likely to have come from distressed shorts having to cover their positions on the exchanges, compounded with fears about supply from Russia and low levels of visible inventory on the LME, prices are likely to fall back before too long.”

Alongside nickel, the metals buying frenzy whipped up prices for zinc and lead.

In early trading, zinc prices jumping as much as 18.4 per cent to a record $4,896 a tonne, while lead soared as high as 9.4 per cent, and tin hit a record $51,000.