LG Energy Solution becomes South Korea’s second-most valuable firm after formidable debut

LG Energy Solution (LGES) saw its stock price soar 68 per cent following its trading debut, as the battery maker becomes South Korea’s second-most valuable company.

The company raised 12.8tn won (£7.9bn) in the IPO earlier this month: Asia’s biggest equity fund raising since China’s Alibaba Group raised $12.9bn in its Hong Kong secondary listing in 2019.

Analysts believe that LGES’ success signals another strong year for Korean initial public offerings (IPO), drawing more institutional investors into the country.

Over 20 companies went public on South Korea’s main stock board last year, raising about 17 trillion won, nearly double the previous record of 8.8 trillion won in 2010, according to data from bourse operator Korea Exchange.

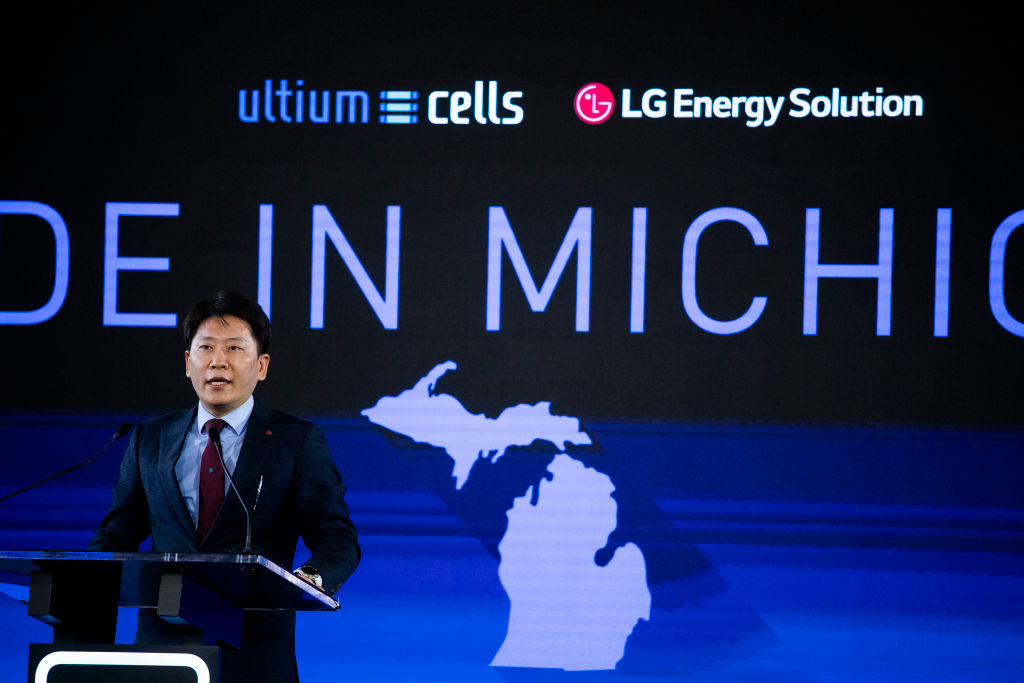

LGES is a spin-of from South Korea’s biggest chemical company LG Chem, which has LG Corporation, the UK household name, as a parent company.

The company accounts for more than 20 per cent of the global electric vehicle battery market, with clients including Tesla, General Motors and Volkswagen.

Just this week, it announced plans to build a $2.6bn battery factory in the US with General Motors.