Land Securities bucks the trend as customers flock to its shopping centres

Land Securities said visitors to its shopping centres hit record levels in the third quarter, after a change in its strategy to focus on better quality properties paid off.

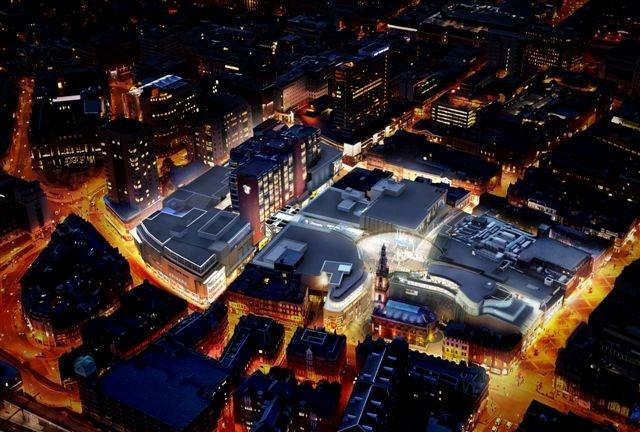

The listed property giant, which owns Bluewater shopping centre in Kent as well as Trinity in Leeds, said footfall rose by 1.7 per cent in the quarter and by 4.2 per cent in the year to 3 January.

However like-for-like store sales fell 0.8 per cent year-on-year as customers spend less in bricks and mortar stores and more online.

Chief executive Rob Noel said retailers were responding to changing shopping habits by upsizing stores in key shopping centres to create “showrooms” for customers to browse their brand.

“Retailers don’t care (if sales are from stores or online). They are worried about sales overall,” he said.

The group said the demand from new tenants was also strong in the quarter, after securing 186,000 sq ft of development lettings worth £13.7m with a further £4.2m in solicitors hands.

Its recently completed schemes include the Zig Zag building in Victoria, which is now 88 per cent let to tenants including Deutsche Bank Asset Management and Private Wealth Management.

It also made £450.5m of disposals – more than it made in the entire first half – bringing the total to £852.6m for nine months to date.

Land Securities' adjusted net debt stood at £3.53bn at the end of the quarter compared with £4bn at the end of September 2015.

"We have a portfolio of fantastic assets now and the business is in great shape," Noel said.

"We are delivering on our clear strategy for the business and, despite economic and political uncertainty, are confident in the strength of demand for our schemes."