Johanna Kyrklund: the FOMO market is over – so, what’s next?

Maybe lockdown has made me more middle aged and boring. I’m just not as interested in trendy stuff any more, both in my personal life (I opted for a VW ID3, not a Tesla, after all) and now in investing.

But in today’s markets a more boring approach – favouring diversification and judiciousness over more racy assets – may be what’s required.

The spice of life?

It’s been almost exactly a year now since here in the UK we were all sent home from our offices and got used to a life with significantly less variety. Who needs restaurants, cinemas, friends and holidays anyway, right?

I joke, but for some, a lack of variety was hugely beneficial in 2020. Stock market investors who eschewed variety in favour of a few powerhouse stocks could have done very well indeed. Many with a diversified portfolio were ruing their prudence as they saw a small cohort of tech giants perform outstandingly.

The share price of the newly self-anointed “Technoking” Elon Musk’s Tesla – to use an extreme example – surged 695% in 2020 alone.

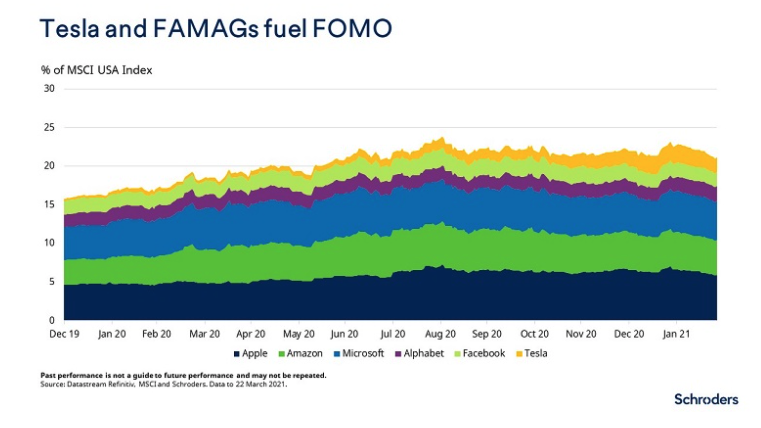

The chart below illustrates how the US market became increasingly dominated by a small number of stocks, the FAMAGs (Facebook, Amazon, Microsoft, Apple and Google) and Tesla. As a result of their surging share prices, these six stocks now account for 21% of the MSCI USA index of 600 companies, and 22% of the S&P 500 index, which Tesla only joined this year.

No wonder the “FOMO market” was born. This fear of missing out, using an acronym previously avoided by anyone over the age of 30, led many investors of all stripes into what appeared to be a one-way-street for making money.

Discover more from Schroders:

– Learn: What 175 years of data tell us about house price affordability in the UK

– Read: The equity sectors best at combating higher inflation

– Watch: The telecoms business which pioneered a payment system lifting thousands out of poverty

A bird in the hand…

The proverb that a “bird in hand is worth two in the bush” flew out of the window. Investors were putting more weight on a company’s potential (and sometimes imaginary) profits in the future than they were on profits today.

This was in no small part down to what’s known as the “discount rate”. When investors calculate the value of a company’s future cash flows, this plays a crucial role. In short, the lower the discount rate, the more valuable a company’s future profits are.

So, in an environment where interest rates and government bond yields are at or near zero, a company’s future potential profits are highly valued. Hence the appeal of fast-growing companies with potentially bright futures like Tesla.

However, when the discount rate rises, the hurdle for what makes a good investment rises. Suddenly the certainty of the proverbial bird in the hand becomes more valuable, while the two birds in the bush need to really justify their valuations.

This is what’s been happening recently as the yields on US Treasuries have risen (prices have fallen). This is because markets have started to anticipate higher inflation (which is anathema to bond investors) as a result of a strong economic recovery.

Could growth disappoint?

I actually think that the expectations for economic recovery might be overdone, and there is scope for disappointment.

Though I am far from pessimistic on the economic outlook, there is the possibility that high hopes are not met. As Europe slides back into lockdown amid rising cases and a poor vaccine rollout, it’s a reminder that Covid-19 has not gone away by any means.

What’s more, the willingness and capacity of people to suddenly return to “normal” activity may be overestimated. Flights, for example, are now significantly more expensive than before, as I found out recently when attempting to visit my mother in Italy. So will there really be a sudden resurgence in travel and tourism, even supposing people are allowed and not too nervous to do so? Similarly, will people really want to eat outdoors in the UK’s notorious April showers?

Then there’s the risk of the vaccine rollout faltering as politics or supply issues get in the way.

Contrary to some market expectations, I think it’s not guaranteed that it’s plain sailing back to normality from here.

Three trades for rising yields

The FOMO market is over; it’s a more broad based opportunity set now and a more “normal” investing environment. Investors will be able to bide their time, waiting for openings.

So where am I looking currently?

I’ve written previously about the opportunity in recovery stocks – those placed to benefit from an economic recovery- but now this has evolved. I would highlight three areas of interest to me as a multi-asset investor today.

- Japanese equities. When Treasury yields rise the Japanese market has historically tended to do well. This is because as bond yields rise, the dollar tends to strengthen versus the yen. Japan is an export-orientated economy, so a cheaper yen makes Japanese goods more appealing. The industrial sector is also a dominant part of the Japanese economy, which should do well as the global economy gets back on its feet.

- Value. Value investing means buying good quality companies that are trading beneath their true value. When the discount rate rises, as we’ve discussed, so does the appeal of real earnings today (not imaginary earnings in the future) that you don’t have to pay over the odds for. This is the proverbial bird in the hand.

- The UK. Like value stocks, the UK equity market is an area that has been unloved and untrendy for some time now. With the double whammy of Brexit uncertainty and Covid, the market has underperformed its peers significantly in recent years and there is potential for a catch-up. What’s more, for investors in the UK with sterling strengthening, it may be worth keeping some money in their home market.

Elsewhere, I can see bond yields rising further from here, but I am not anticipating the current selloff getting much worse. Indeed, bonds may gain in attraction later in the year.

One area I would be avoiding currently is gold. Although traditionally seen as an inflation hedge, I don’t think we are seeing the “right type” of inflation now, in that gold performs less well in these early stages of an inflationary cycle.

Another investment I would avoid is perhaps the ultimate trendy asset, bitcoin. I do not consider it an investment – it’s purely speculative. This is an unfashionable opinion to some. But if diversification, patience and prudence are coming back into vogue, maybe Huey Lewis and the News’ hit song from the 1980s was right: it’s hip to be square.

Topics:

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.