JD Wetherspoon toasts Christmas sales but warns on debt

Pub chain JD Wetherspoon reported this morning that sales were up over the Christmas period, but warned that full-year debt will be higher than expected due to a spike in capital expenditure.

The pub operator said like-for-like sales in the 12 weeks to 19 January increased 4.7 per cent, and total sales were up 4.2 per cent.

In the financial year to date, like-for-like sales increased five per cent and total sales jumped 4.9 per cent.

Wetherpoon said net debt will be between £780m and £820 due to capital expenditure on property and share buybacks, saying it expects to spend £80m on new pubs and extensions in this financial year.

In the year to date, the company has spent £57m buying the freehold reversions of 18 pubs where it was previously the tenant, and full-year expenditure is expected to be £77m.

A total of £320m has been spent on reversions since 2014, and the company has spent £516m on buying and cancelling 53 per cent of its own shares since the buyback program started in 2003.

In a statement this morning Wetherspoon said: “Expenditure on reversions and buybacks, referred to above, approximately equals company debt – if the company had not bought shares or reversions it would be more or less debt-free, having financed dividends, the repayment of 2003 borrowings of approximately £300m and the opening of a net 239 pubs, from free cash flow.”

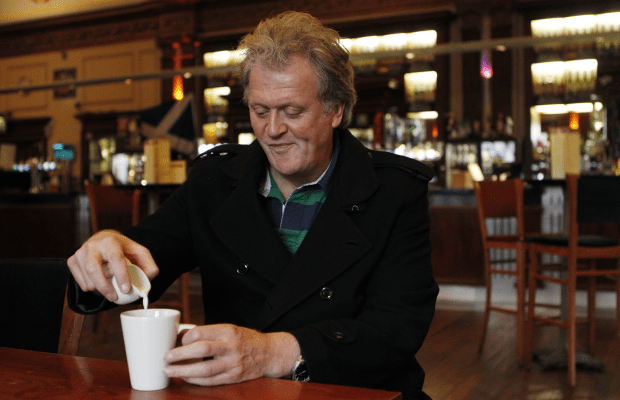

Wetherspoon chairman Tim Martin also used the second quarter trading update to reiterate his attack on UK corporate governance and in particular shareholder advisory firm Pirc.

Martin, a vocal supporter of Brexit, added that pro-remain organisations were “doubling down on ‘project fear’ stories”, saying “it is high time these organisations took a wise-up pill and supported the democratic decisions of the UK.”