IMF warns Germany and UK will be G7’s laggards this year despite upgrades

Britain is on course to register the second weakest growth in the clutch of rich countries this year, beaten only by Europe’s economic powerhouse Germany, which will be the only advanced economy to contract this year, the world’s lender of last resort has signalled today.

UK output will expand 0.4 per cent this year, the International Monetary Fund (IMF) said in new forecasts out today that confirm an earlier upgrade published in May.

It is a 0.7 percentage point upgrade from its last set of full forecasts back in April.

The Washington-based organisation still does not think Britain will slip into recession despite growing economic headwinds of late reigniting slowdown fears.

Other top economic institutions canned their recession forecasts in the early months of 2023 after UK GDP outperformed expectations.

Greater optimism about the UK economy has been fashioned by “stronger-than-expected consumption and investment from the confidence effects of falling energy prices, lower post-Brexit uncertainty (following the Windsor Framework agreement), and a resilient financial sector as the March global banking stress dissipates,” the IMF said.

Resilient consumer spending has shocked analysts who had expected rising prices to wipe out living standards and prompt Brits to hunker down.

“Growth in the United Kingdom is projected to decline from 4.1 per cent in 2022 to 0.4 per cent in 2023, then to rise to one per cent in 2024,” the IMF said.

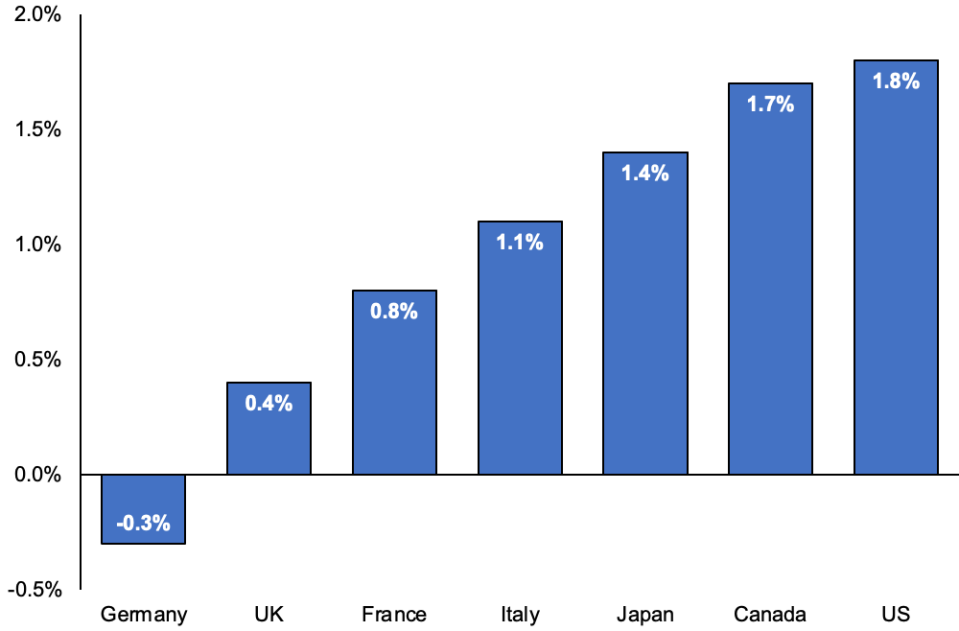

G7 growth projections by the IMF

A recent surge in mortgage rates has compelled experts to re-raise the threat of recession hitting the UK either toward the end of this year or sometime next year. The Bank of England has warned nearly 1m people could be paying £500 more a month to their home loan providers in a few years.

Threadneedle Street is now tipped to lift rates from their current level of five per cent to a peak of around 5.75 per cent, down from 6.25 per cent. A smaller 25 basis point rise is priced in for next Thursday’s monetary policy committee meeting. Before last week’s inflation numbers, a 50 basis point rise was expected.

Tighter monetary policy cools an economy by reining in spending by making it more expensive to borrow and more attractive to save. It also puts downward pressure on house prices, which can knock consumer sentiment.

Bank governor Andrew Bailey and co have lifted borrowing costs 13 times in a row.

Germany, Europe’s largest economy, is poised to anchor the G7 growth league, shrinking 0.3 per cent this year, a downgrade from the minus 0.1 per cent projected by the IMF in the spring.

America, the globe’s biggest economy, will top the G7 growth table, expanding 1.8 per cent in 2023.

Canada comes second (1.7 per cent), Japan (1.4 per cent) third, Italy (1.1 per cent) fourth, France (0.8 per cent) fifth, tailed by Britain and Germany.

Global GDP growth will reach three per cent this year, a 0.2 percentage point bump.

Pierre-Olivier Gourinchas, IMF director of research, said: “The global economy continues to gradually recover from the pandemic and Russia’s invasion of Ukraine.”

“In the near term, the signs of progress are undeniable,” he added.