Here’s why 2014 could be a great year for the US

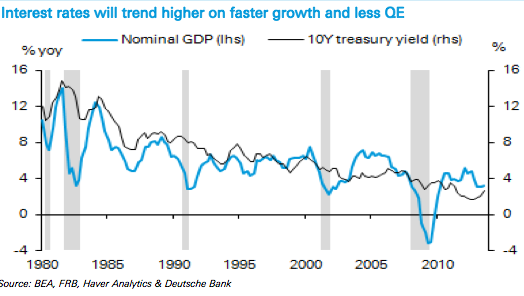

The US economy is transitioning to faster growth and higher interest rates, according to a research note by Deutsche Bank.

Joseph LaVorgna, Chief US Economist said:

We expect monetary policymakers to soon transition to a slower pace of monetary accommodation. This implies that over the next year, long-term interest rates are poised to rise significantly higher, reflecting these improving economic growth prospects.

The US economy has continually improved since the first quarter when higher taxes hit GDP growth. Output has steadily increased growing 3.6 per cent in the last quarter at annualised rate. This is expected to continue as the job market strengthens and the housing sector recovers.

The rate of GDP growth has steadily improved, with output expanding by 2.5 per cent in the second quarter and 3.6 per cent in the third quarter. at annualised rate

Economic momentum should continue into the fourth quarter with output close to three per cent. This should have a positive impact on the unemployment rate, which Deutsche Bank expects to reach 6.4 per cent by the end of 2014.

Deutsche bank point to the levels of output to make their case. Real output is up 5.3 per cent from the pre-recession high, but the November level of employment is 1.3m lower than the January 2008 peak of 138.1m. The economy has been consistently producing more with fewer workers, largely through stretching the length of the working week.

However, the average working week is now approaching pre-recession levels. Deutsche Bank believes that a sustained improvement in the pace of hiring is becoming inevitable. The note argues that the level of output of the existing workforce can only be stretched so far until companies must add additional workers.

As well as declining unemployment, headline inflation is expected to remain low due to declining energy costs. With the Fed possibly beginning tapering as early as next week Deutsche Bank expect asset purchases expected to be wound down completely by September/October next year. However, the first hike in interest rates is not expected until sometime in 2015.

Deutsche Bank believe that higher interest rates will not have a major impact on growth because they will still be at historic lows. Previous fears that the economy was too weak to endure a less accommodative monetary policy now seem overly pessimistic.