Hedge funds braced for a major crisis

Managers are facing their toughest year since 1990, finds David Crow

Once seen as the best way to make money whatever the state of the market, the magic glue that held the hedge fund sector together is beginning to come unstuck amid the intense heat of the credit crunch. Barely a day goes by without more bad news for the industry.

Setting World Records

Yesterday it was the announcement that Ospraie is planning to close its flagship fund after it plunged more than 27 per cent in August on huge losses in energy, mining and natural resources equities. With $2.8bn (£1.58bn) under management, it will be one of the biggest ever closures of a commodities-focused hedge fund.

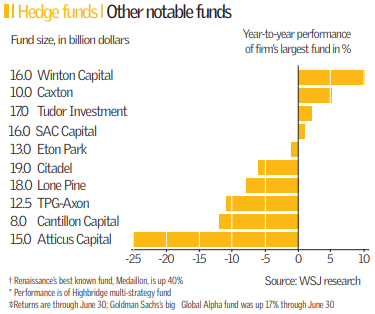

Records were also set earlier in the week when high profile New York hedge fund manager Atticus posted one of the biggest falls in dollar terms the industry has ever seen, shedding $5bn (£2.7bn).

The First To Fall

Ospraie might have been among the first to fall, but it is by no means alone. According to research firm Hedge Fund Research, 2008 is shaping up to be the hardest year the industry has seen in 18 years, with the average fund losing 3.43 per cent in the six months to the end of July.

And the $1.9 trillion industry received just $30bn of new money in the first two quarters of the year, compared to $119bn for the same period last year.

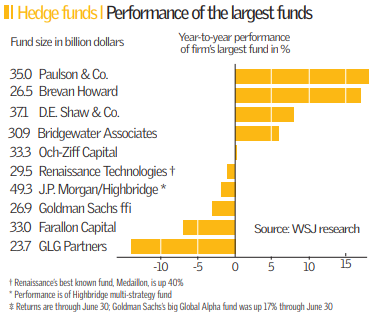

Other bellwethers are also showing signs of choppy waters ahead. Ken Griffin’s biggest fund at Citadel is down six per cent this year – its worst performance in 14 years – while Andor Capital is also closing its doors.

The credit crunch has hit many funds hard. Managers often rely on borrowing capital to take short positions and deliver strong returns but with credit drying up they have found it harder to follow this strategy.

When The Chips Are Down

Hedge fund economics also make it difficult for managers to survive when the chips are down. In exchange for a hefty cut of trading profits – normally around the 20 per cent mark – they guarantee investors that they will recover any losses before they take their share.

So a fund that clocks up losses won’t be able to make profits beyond their management fees, impacting on the bonuses of traders and analysts who end up leaving for newer and more lucrative pastures.

Cash-rich private equity firms are more than happy to pick up the cheap assets that are overlooked by now cautious hedge funds – who are reeling from the fact they bought assets they thought had bottomed out only to see them get cheaper. For the funds that do make it out the other side of the crunch, they’re sure to find that some of the best deals have been had.

Crunch Time Ahead

All eyes are now on 30 September, the date when nervous investors are allowed to pull their cash out of hedge funds. Managers are worried that even those who are happy with a fund’s performance will default because they fear others will. One thing’s for sure, another spate of closures around this time is all but certain.