Royal Mail share price drops as government announces plans to sell off its remaining stake

Shares in the Royal Mail fell more than three per cent to 510p in early afternoon trading, after the chancellor said the government will begin selling off its remaining stake in Royal Mail this year.

Read more: Royal Mail revenues rise by a measly one per cent

During a debate over the contents of the Queen's Speech, George Osborne said it had appointed Rothschild to advise the Department for Business, Innovation and Skills on the sale of its remaining 30 per cent stake in the business.

"It is the right thing to do for the Royal Mail, the businesses and families who depend on it – and crucially for the taxpayer," said Osborne.

The transaction will be designed to deliver "best value for money to the taxpayer", the government said in a statement.

Shares in the business were floated in October 2013 at 330p. Since its IPO, they have risen by almost 50 per cent, closing at 526p yesterday.

Following Royal Mail's listing in 2013, the government was fiercely criticised for its decision to allocate a vast proportion of shares to institutional investors.

Today Laith Khalaf, a senior analyst at Hargreaves Lansdown, urged the government to focus on individuals.

Osborne tightens the belt – again

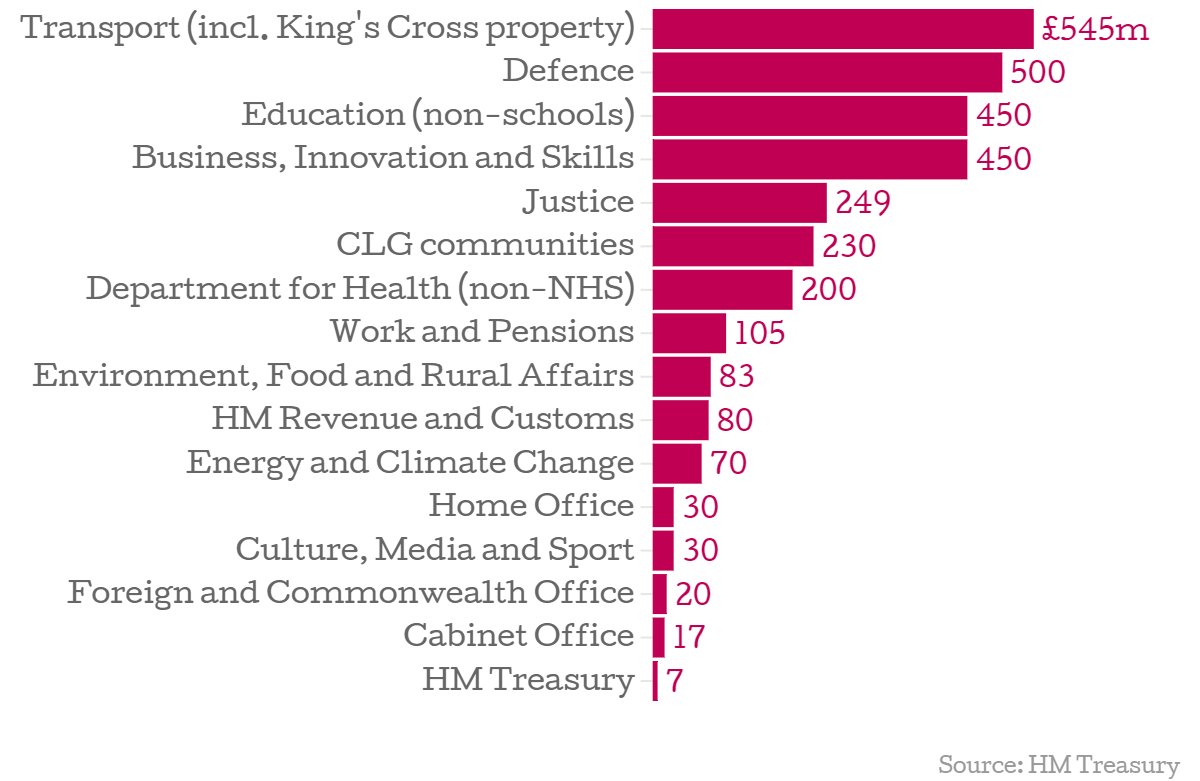

The proposals were part of £4.5bn of measures announced today by the chancellor to help pay down debt.

Whitehall departments that aren't protected (ie. not the NHS, education or foreign aid) have found a further £3bn of savings this financial year through "further efficiency savings, tighter control of budgets to drive underspends and driving through asset sales", he said – equivalent to three per cent of unprotected departmental spending this year.

Among the assets earmarked for sale is the land around King's Cross, valued at £345m.

"Reducing the deficit – that is how you deliver lasting economic security," said Osborne.

Savings bonanza: how departmental cuts stack up