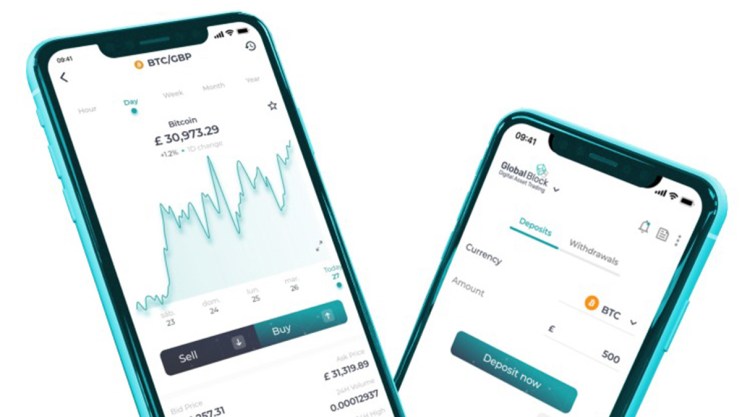

GlobalBlock Launches New Upgraded Trading App

GlobalBlock Europe, UAB (“GBE“), a subsidiary of publicly listed GlobalBlock Digital Asset Trading Limited (TSXV: BLOK) (OTC Pink: BLVDF) (FSE: BD4) (the “Company” or “GlobalBlock“), is pleased to announce that GBE has successfully launched its new mobile trading app. The enhanced technology and feature rich app complements GBE’s service led provision of digital asset services, which includes a dedicated and personalised telephone service.

This customer focused approach has allowed GBE to navigate the recent volatility in crypto markets, affording its clients the service and protection expected of respectable and traditional, well risk managed brokerage companies. GBE also ensures client assets have no inappropriate exposure to leverage, stablecoins or yield products and takes no proprietary positions against them.

The new enhanced features of the app include:

- Live in-App support bringing you even closer to the trading and support teams

- Major assets tradable in-App, with multiple tradable pairings denominated against USD, GBP, EUR and USDT

- Circa 100 other assets available for trading over the telephone and via our new in-App ‘contact’ function

- All your crypto balances and digital asset positions viewable in-App

- Seamless in-App fiat and crypto deposits

- Free withdrawals at any time

- Responsive, intuitive and user friendly experience guaranteed

As of today, the app is downloadable from both the iOS App Store (link here) and Android Play Store (link here). In a week’s time GBE will undertake its marketing push to drive downloads and client acquisition, with a focus on the UK market to start with.

Rufus Round, CEO of GlobalBlock, said:

“At a time when many other crypto firms are under pressure from the recent developments within the industry and reining in investment in their technology, here at GlobalBlock we are preparing for the continued adoption of digital assets with the launch of our new app.

“Our technology upgrade is a foundational development for us as we continue to expand our digital asset product and service offering. We now have the ability to scale quickly, a development that has been delayed slightly whilst awaiting regulatory clarity. Now that we have this clarity, having established the business in Europe, we can commence our marketing efforts in earnest.

“As a highly experienced team from traditional finance and investment management, we understand the importance of risk controls and safeguarding client assets. It is worth reiterating that GlobalBlock does not partake in any lending, nor does it have any exposure to stablecoins or yield products that could put client assets at risk.”