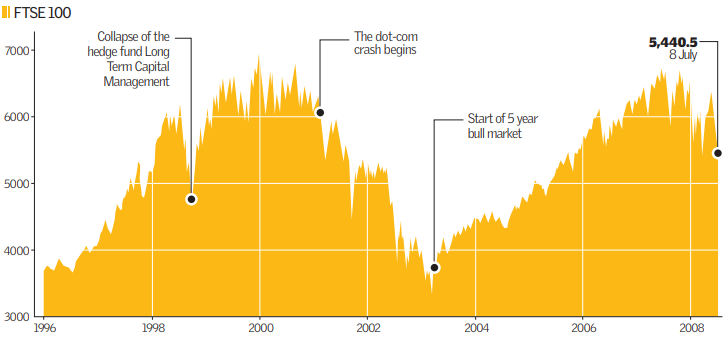

FTSE 100 flirts with bear market

London’s leading blue chip share index lurched into official bear market territory yesterday before recovering to end the day lower, but temporarily out of the danger zone.

The FTSE 100 index fell below 5,385 points in early trading, 20 per cent below its June 2007 peak of 6,732, putting it in official bear territory, defined as a 20 per cent fall from peak to trough, although it later closed at 5,440.5.

Strategists attributed the falls to concerns about the state of the world economy and the impact of slower growth on company earnings. “The main story is the macro environment. Commodity and oil prices are the key to changing the inflation landscape.

“Until that has been resolved it’s hard to be optimistic,” said Ian Richards, strategist at Royal Bank of Scotland. Strategists are now expecting the FTSE to fall further.

“It may just be a matter of time before 5300 is cracked,” said David Jones, chief market strategist at spread better IG Index. But Jeremy Batstone-Carr, equity strategist at broker Charles Stanley said investors were becoming overly fixated on definitions.

“A 20 per cent fall is a psychological obsession. But it is really only a threshold for a bear market. It is characterised by duration as much as depth.”

Batstone-Carr said uncertainty remained over whether all the economic variables had been fully priced in, but expected inflation to fall back as growth slowed.

The G8 group of industrialised nations, meeting in Japan yesterday, voiced strong concern about surging food and oil prices, which they said posed risks to the global economy.

City Views: Where do you think the FTSE 100 will end the year?

Drew Harvey (Insurance Broker at Oxygen Insurance): “We’ll mostly see peaks and troughs over the next few months before it stabilises. The credit crunch has a huge impact on any firm in the FTSE 100 and it has an effect on trading, naturally. Still, I don’t think we’ll see anything too exciting in the near future.”

Nina Doneva (Portfolio Manager at BGI): “It will probably drop about 10 per cent from where it is now. Any drop will probably have an effect on the general economy. The more bad news that comes out, the more people will buy into it. I’m certainly buying into the doom and gloom.”

Andrew Goodwin (Consultant at M&G Investments): “It will probably end at about 4,900. The banks aren’t doing well right now, and consumer spending is down. That’s going to hit food and clothing retailers – their profits will drop. It’s going south, but things will improve with time, of course.”