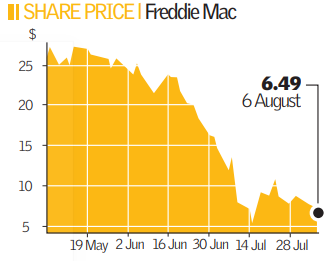

Freddie Mac posts fourth loss in a row

Freddie Mac, the US mortgage giant whose near-collapse led US Treasury Secretary Hank Paulson to introduce emergency rescue measures for banks, announced losses of $821m (£421m) in the second quarter yesterday.

It was the company’s fourth successive loss, as increasing numbers of homeowners failed to make loan repayments in the worst US housing slump since the Great Depression.

Freddie Mac, which alongside sister group Fannie Mae guarantees around half of all US mortgages, worth about $5 trillion, saw a 2007 first-half profit of $729m reversed, making losses of $821m, or $1.63 a share. The US subprime mortgage crisis has seen Freddie Mac suffer cumulative losses of more than $4.6bn in a year.

The lender said it would cut its dividend by 80 per cent to 5 cents a share and also restated its intention to raise another $5.5bn in capital.

Losses proved greater than expected, as credit-related expenses doubled to $2.8bn and the company was forced to write off $1bn on the value of its subprime mortgages.