Four charts that show how remittances are helping growing economies

The World Bank published a great briefing paper on remittances this month, and the data is staggering. Remittances (the flows from non-residents to residents) are expected to $540bn (£338bn) by 2016.

We've got four charts from that paper that show just how vital remittances are to growth.

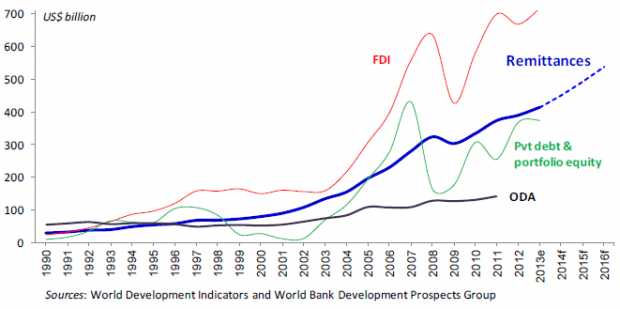

1. Remittances are huge

Even your armchair economist know that foreign direct investment (FDI) is vital to a developing economy. Now we're becoming aware that remittances are an increasingly large part of this picture. They're now at three times the size of official development assistance (ODA), and larger than private debt and portfolio equity flows to developing countries.

2. When we said huge, we meant it

Remittances are also massive when compared with foreign exchange reserves of many recipient countries. They're equivalent to at least half of the level of reserves in more than over 26 developing countries. The World Bank says that as emerging markets face a weakening balance of payments, the importance of remittances as a source of foreign currency earnings is increasing.

3. So huge that they account for nearly half of Tajikistan's GDP

Without any movement of labour, Tajikistan's economy would be around half the size it is now.

4. But it's still too costly to move money

It's still really hard to transfer money around the globe, and the costs aren't falling as fast as we'd like. While the G20 has been aiming to reduce costs to five per cent in five years, efforts have plateaued at around nine per cent. Despite available technology advancing and falling information costs – remittance costs have been stuck at that nine per cent level over the past 12 months.

The story of remittances is still largely positive. They're going up, and they're much larger than conventional aid. But things could be improved by reducing costs – making it easier for people to move for work and to send money home.