First half of Help to Buy scheme signed off 12,000 loans in 2013

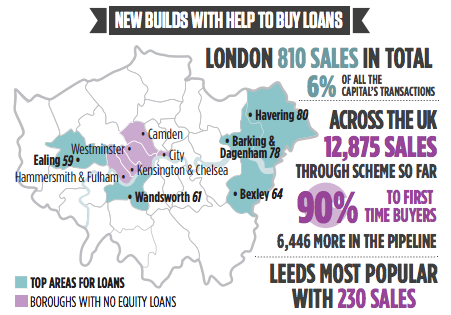

THE FIRST part of the government’s controversial Help to Buy scheme provided mortgages for 12,875 new builds in 2013, while some London boroughs saw nobody use the policy.

Unlike the second half of the scheme, the equity loans which have been on offer since April only apply to newly built homes. The government offers a loan worth up to 20 per cent of the property’s value so the buyer only needs a five per cent deposit.

There has been an enormous variation in demand for the scheme in London. Some wealthier boroughs, like Kensington and Chelsea, Westminster, and the City of London, have seen no uses of the scheme at all. In comparison, 78 transactions have already been recorded in Barking.

The second half of the scheme, which came into force late last year, has come under more criticism, and applies to all properties whether newly built or not.

Leeds is the most popular metropolitan district for the equity loan scheme, with 230 sales in the programme’s first eight months.