Fear, Anxiety, Doubt – FUD

Crypto at a Glance

Beware FUD! Last week’s barrage of mistruth reportedly claimed a major victim in software company NexTech AR Solutions, which sold off all 130 of its Bitcoins (worth roughly $4 million), citing reports of a possible “double spend” on the blockchain. The supposed double spend has now been shown to be nothing of the sort, but it was still credited for much of last week’s downward price action. An important lesson for newcomers to the space – do your own research and don’t believe everything you read. Certainly don’t make $4 million decisions off the back of easily-disproved nonsense spread by gutter press.

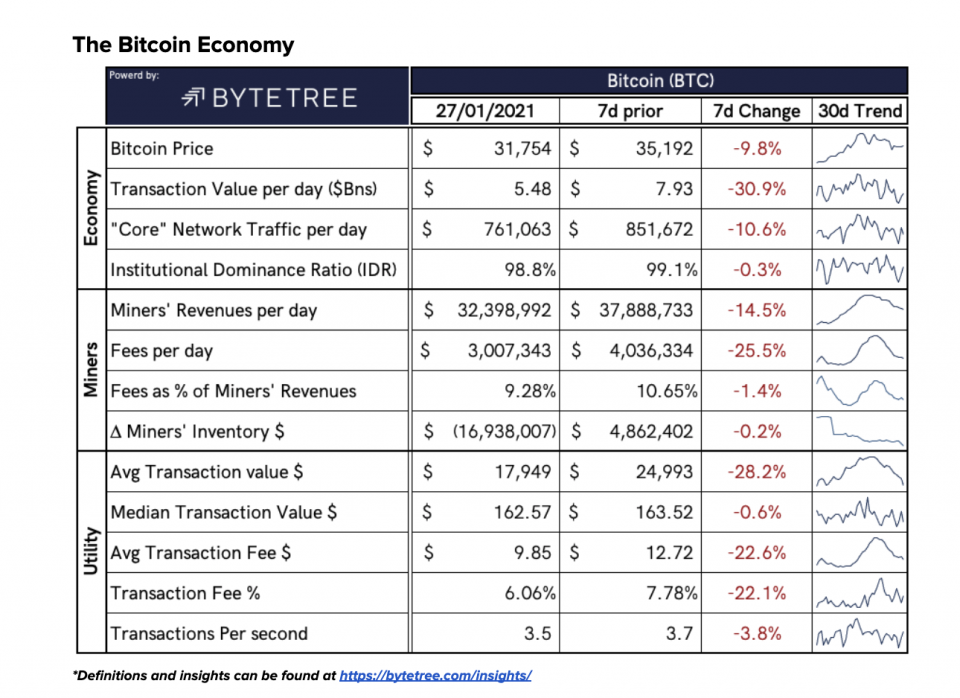

The rumours certainly didn’t slow others down, though. MicroStrategy announced earlier this week that it bought “approximately 314 bitcoins” for $10 million, at an average price of $31,808 per BTC, during the dip. As noted yesterday, Nasdaq-listed Marathon Patent Group has also converted $150 million of its treasury reserves into Bitcoin. A trickle becomes a flood. In a world of NexTechs, be a MicroStrategy.

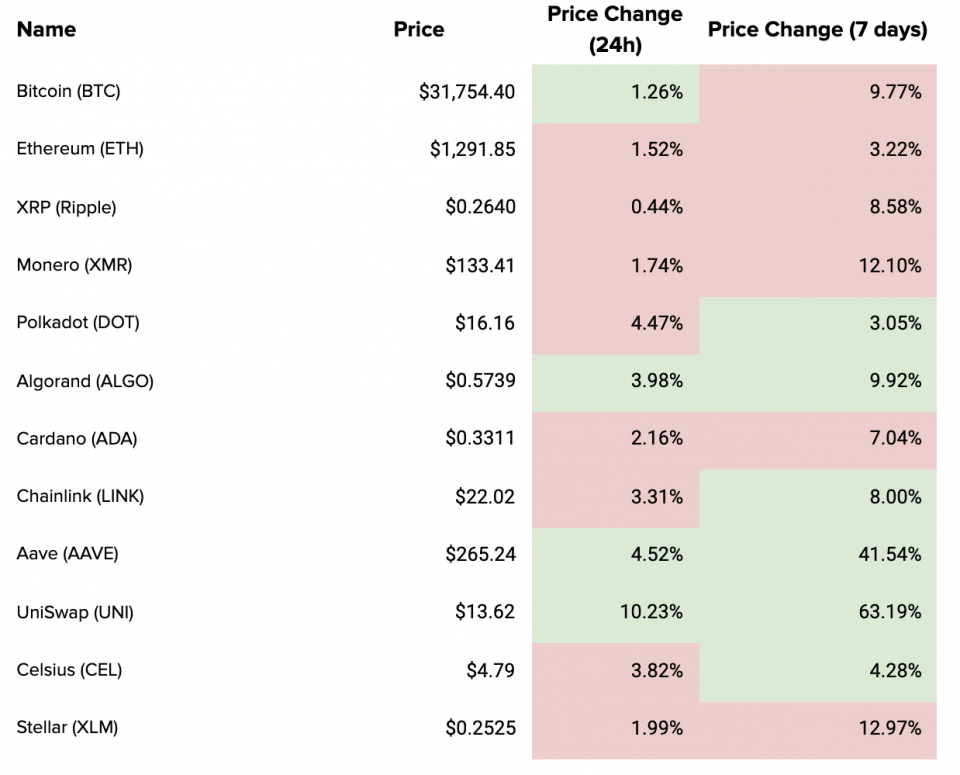

Elsewhere, Ethereum has now closed 22 consecutive days over $1,000 – back in the January 2018 bull run it only closed 16 straight days in 4 figures. It continues to look a bit flat after this weekend’s all-time high excitement, though. This is broadly true across the crypto markets this week, though Uniswap and Aave continue to look impressive after hitting new all-time highs.

In the Markets

What bitcoin did yesterday

We closed yesterday, 26 January, 2020, at a price of $32,569.85 – up from $32,366.39 the day before. That’s the fourth green candle day in a row, although these incremental climbs are very restrained for Bitcoin.

The daily high yesterday was $32,794.55 and the daily low was $31,030.27. That’s the lowest daily high since 1 January, 2020.

This time last year, the price of bitcoin closed the day at $8,596.83. In 2019, it was $3,602.46.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

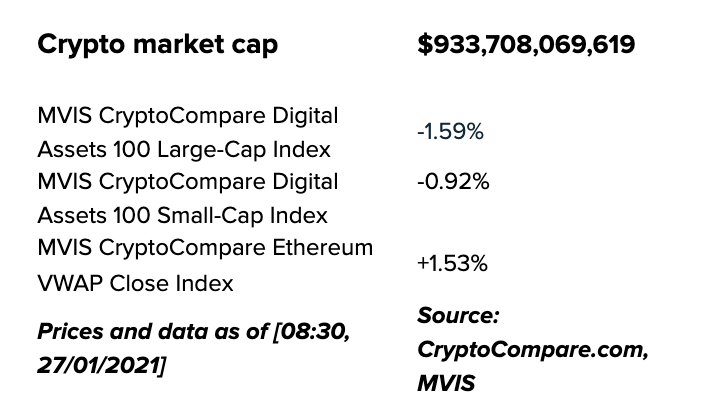

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $592,257,167,594, up from $584,239,934,626. It’s back above the Taiwanese Semiconductor guys, but there’s quite a bit of air until we’re back up there with the likes of Facebook and Tesla again. The market cap of gold today is $11.721 trillion.

Bitcoin volume

The volume traded over the last 24 hours was $57,788,042,739, down from $59,643,260,798 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 97.75%.

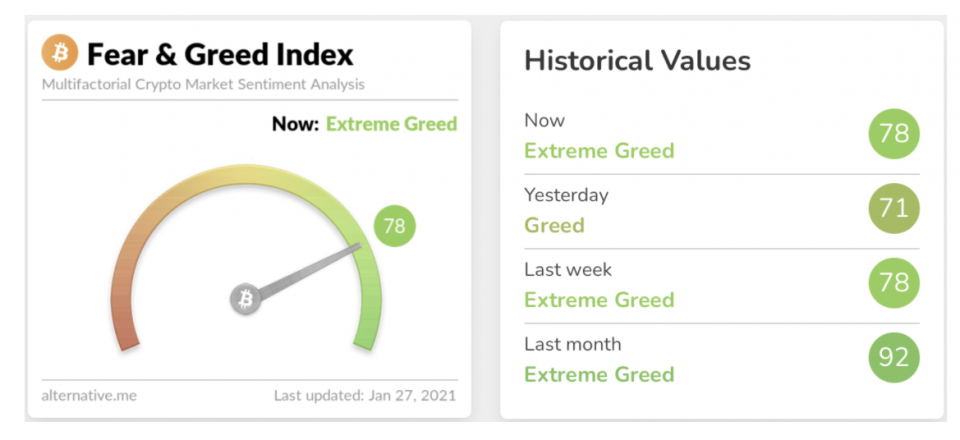

Fear and Greed Index

The sentiment Index is back in Extreme Greed for the first time in a week, up from 71 to 78. It’s important to remember that the index doesn’t usually stay this high for very long and could mean a correction is on the cards.

Bitcoin’s market dominance

Bitcoin’s market dominance is currently 63.96. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 46.41. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Google trends

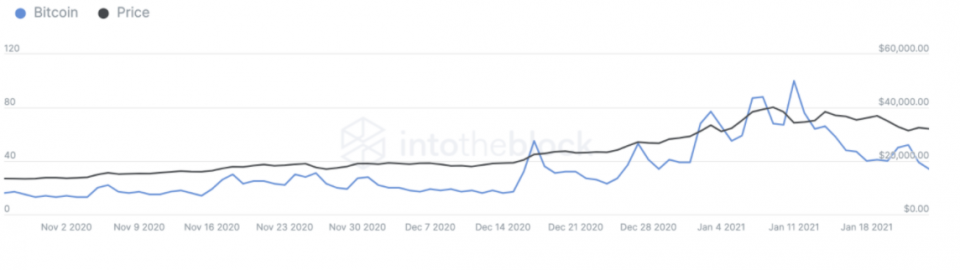

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 34– taken from 24 January.

Convince your Nan: Soundbite of the day

“I think the fact that within the bitcoin universe an algorithm replaces the functions of [the government] … is actually pretty cool. I am a big fan of Bitcoin.”

- Al Gore, 45th Vice President of the United States

What they said yesterday…

Congratulations to Estonia

How times change

Can you buy coffee with it though?

To be fair, he would say that

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM reshines its Spotlight on CUDOS

Crypto AM: Industry Voices

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno