Exclusive: UK firms stop hiring and mull layoffs as recession takes hold

Layoffs are on course to climb, driven by businesses cutting costs amid what risks being the longest UK recession in memory, exclusive research shared with City A.M. indicates.

Firms are planning to pause hiring or even sack workers to protect their finances from a slump in spending sparked by the cost of living crisis.

Nearly four in five companies plan to keep staffing levels unchanged in 2023, according to figures compiled for City A.M. by small business lender Iwoca, suggesting uncertainty over the pending economic slump is set to freeze the jobs market.

The figures add to the growing list of recent surveys signalling the country is in the early stages of a drawn out slowdown.

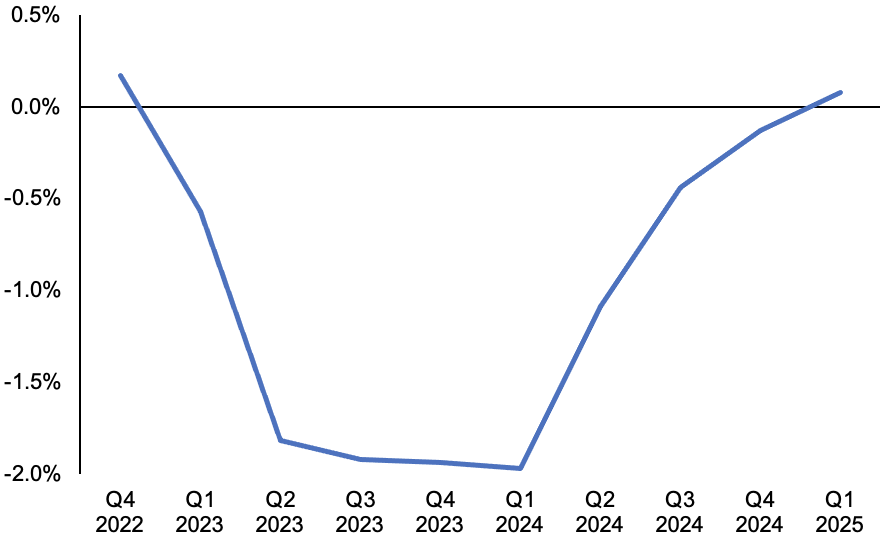

Fresh GDP figures out this Friday are expected to show the economy contracted around 0.3 per cent in November, meaning the country almost certainly met the technical recession definition – two back-to-back quarters of negative growth – in the final three months of 2022.

Separate research by consultancy BDO reinforced Iwoca’s numbers, with its employment index in December tumbling to its lowest level since January 2022, when the UK was winding down Covid-related restrictions.

Hiring plans are also the bleakest since the final months of 2020, a period in which most Britain was locked down to tame the rise in Covid-19 cases.

“Inflation and supply chain pressures are clearly being felt across the board, as employers pause recruitment plans and consider redundancies to manage rising costs,” Kaley Crossthwaite, partner at BDO, said.

The Bank of England has warned the UK recession could be the longest in a century, but only if it raises interest rates above five per cent, which it is unlikely to do.

BoE’s recession forecasts are bleak

The most likely outcome based on City economists’ projections is for the slump to last the whole of 2023, which would still be relatively long. However, the around two per cent GDP hit would make it a shallower recession by comparison.

BDO’s output index ticked up slightly to 91.65, but the reading is still below the 95 point threshold that separates growth and contraction, indicating activity has settled at a lower level.

Its inflation index did cool for the second month in a row to 117.91, chiming with economists predictions that the rate of price increases has passed its peak and will fall throughout 2023.