Recession spreads to British construction as experts brace for a jump in unemployment and the cost of living

British builders are being dragged into a slump by the recession that has taken hold in the wider economy, a closely watched survey has revealed..

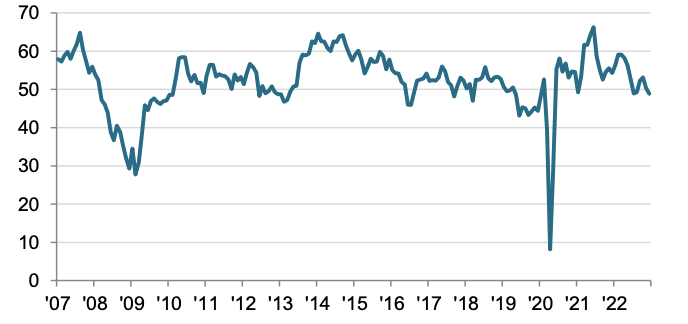

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) final purchasing managers’ index (PMI) for the construction sector for December fell to 48.8 from 50.4.

The reading means Britain’s construction sector is shrinking despite keeping its head above water through the autumn.

The PMI has a threshold of 50 points that separates growth from contraction.

Construction activity is shrinking

Demand in the UK is flat lining in response to elevated inflation eroding customers’ spending power and higher interest rates making it more expensive for businesses and households to borrow.

Wages trailed inflation for most of last year, squeezing Brits’ living standards. Families are also shunning big ticket purchases, such as houses, due to their budgets being railroaded by sky high energy bills.

Figures from bank Halifax today showed house prices fell for the fourth month in a row.

As a result, house builders and other construction firms are reining in production due to uncertainty over whether they shift their products in the future.

“The construction sector managed to keep its head above water through the autumn, but now is being dragged down by the recession in the wider economy and the surge in borrowing costs faced by households and businesses,” Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, said.

Companies are now shedding workers to contain costs to offset the income hit from hobbled demand.

“Anticipating lower activity, more businesses reduced headcounts, pushing down the employment index to 49.1—its first sub-50 reading since January 2021—from 52.4,” Tombs added.

Tombs also noted construction activity may have been constrained by the heavy snowfall in December.

Experts think Britain has entered what may be a year long recession, knocking around 1.5 per cent off of UK GDP.