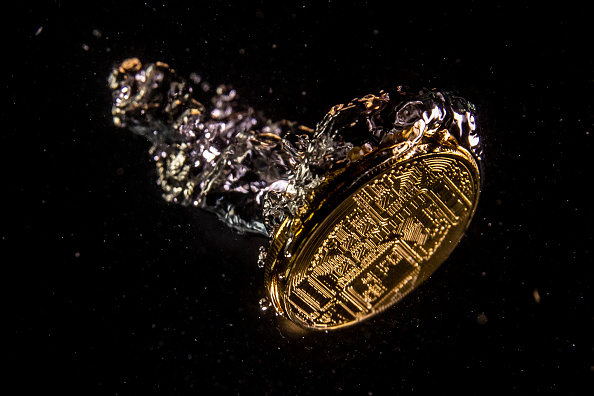

Even in these dark times, remember Bitcoin could still bring some light to the world

The week in review

with Jason Deane

Things have been rough recently for pretty much everyone everywhere – and this week has probably been one of the worst so far this year.

The brutal school shooting in Texas reignited the inevitable arguments about rights versus children’s lives in America while the rest of the world watches in bewilderment.

I am actually old enough to remember the Dunblane and Hungerford shootings in the UK in the 1980s that led to the effective outlawing of private gun ownership here in the UK. I recall my dad surrendering his Colt 45 revolver and Tommy submachine gun in the subsequent weapons amnesty period. Although both were deactivated, it was simply not worth keeping them – and this turned out to be the right move. These days those weapons would have given the owner a mandatory five year minimum sentence.

Of course, that doesn’t stop a Brit like me being amazed at, and even seduced by, the sight of stacks of high powered weapons available for general sale to anyone over 21 in a store, like this one I visited last month in Texas.

And perhaps that’s the problem. If someone like me, who is entirely against private gun ownership, still finds myself wanting to go to a gun shop as a sort of “when in Rome” tourist activity like visiting a museum, how much stronger must that pull be for locals for whom ownership is normalised? It’s something that actually kept me awake the other night.

The acquisition of guns, of course, continues to be the main theme of President Zelenskyy’s addresses to various NATO countries via speeches that have increased in strength and tone in direct relation to the amount of territory the Russians are gaining.

That progress is slow and expensive in economic and human terms, but the knock on effect of the war is also starting to seriously bite on food supply chains, adding to inflationary pressures as well as threatening a global humanitarian crisis.

Very magnanimously, Russia has offered to allow access by sea to the grain sitting in storage silos but only if sanctions against the country are lifted. This seems odd because Putin has been maintaining that they’re doing fine with them in place. I’m not so sure that’s true.

In any case, markets continue to pummelled across all sectors and while Bitcoin struggles with support, spare a thought for those in alt coins. There has been a clear rotation from those to Bitcoin and Bitcoin dominance has grown steadily in recent weeks, now standing at 46 per cent as of this morning.

Nevertheless, the lower Bitcoin price has clearly encouraged some less profitable miners to switch off their machines and soften the hashrate resulting in a significant downward adjustment of well over four per cent this week. It looks like the next adjustment may also go the same way.

Of course, the network remains incredibly robust and while we hunker down and wait out the bad times, we should remind ourselves that not only is this the best time to build, what we’re doing with Bitcoin really can help fix some of these problems and help some of the most affected people.

And that’s an incredibly uplifting thought.

Have a great weekend!

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on Tuesday June 21 at 6pm to find out, ask any questions, and grab some free Bitcoin*. Click here to register.

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/research

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1.202 trillion.

What Bitcoin did yesterday

We closed yesterday, May 26 2022, at a price of $29,267.22. The daily high yesterday was $29,834.16 and the daily low was $28,261.91.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $553.55 billion. To put it into context, the market cap of gold is $11.795 trillion and Tesla is $733.21 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $42.874 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 54.94%.

Fear and Greed Index

Market sentiment today is 12, in Extreme Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 46.65. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 35.97. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Bitcoin is rules without rulers.”

Michael Saylor, CEO of Microstrategy

What they said yesterday

Bitcoin is for everyone…

He has a point…

For the people by the people…

Crypto AM: Editor’s picks

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

Meet the hackers helping people recover lost crypto assets

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto crazy couple name baby after favourite digital asset

Peter McCormack: Transforming Bedford FC into a global Bitcoin brand

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST