Capital Markets Union: Europe’s bid to reboot lending to businesses

Creating large-scale, US-style capital markets in the EU could boost lending to businesses by hundreds of billions of euros, providing a vital boost to its struggling economies, European Commissioner Lord Hill said yesterday.

The vast majority of small firms in the EU rely on bank lending for finance, a dependency which became a serious weakness in the wake of the financial crisis.

If savers had alternative routes to reach borrowers, then policymakers believe capital could be allocated more efficiently and growth improved.

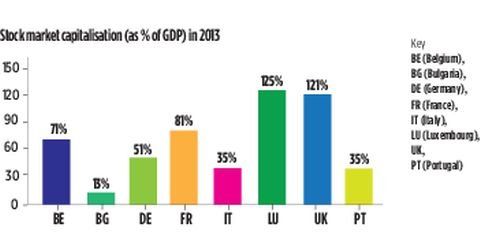

Europe’s venture capital market is only one-fifth the size of the US’ sector. And while US stock markets’ capitalisation amounts to 138 per cent of GDP, those in Europe amount to just 63 per cent – showing it is harder for European firms to access finance.

“Building a single market for capital is a long-term project,” Hill said, warning that he would address “difficult, sometimes long-standing issues such as securities laws, investment restrictions, tax treatments of debt and equity, and insolvency regimes”.

But the Commissioner argued “the prize is worth fighting for: for firms to access funding they need from across the EU; for SMEs to be able to raise finance more easily; for people saving for their futures and retirements to be able to benefit from a wide range of affordable investment opportunities.”

The EU yesterday launched a consultation on ways to remove barriers to the creation of a single capital market.

Hill said he wanted to find ways to make it easier for firms to raise funds in other countries across Europe, harmonising some regulations on prospectuses and tax, and encouraging investors to cross borders with similar protections across the EU.

The British Bankers’ Association welcomed the plan, but warned other policies ran counter to its goals.

“We would like the final proposals to reduce fragmentation and increase the depth of Europe’s capital markets, which will lower the cost of capital, improve its allocation and ultimately better support Europe’s growth companies to create jobs,” said BBA deputy chief Sally Scutt. “But as the capital markets union is being developed policymakers need to recognise that some of their other plans could be counterproductive.

“Introducing a financial transactions tax or restricting banks’ ability to conduct market making activities for their clients through further structural reform could undermine attempts to inject greater liquidity into capital markets.”

Hill took the job in November 2014

THE CAPITAL MARKET PLAN

■ A founding principle of the EU was that capital can flow freely across borders. But different rules in different countries make it hard in practise for firms to raise money abroad, or savers to invest abroad.

■ The European Commission now wants to simplify and harmonise some of the rules in a bid to make a single market, the Capital Markets Union (CMU).

■ The single market in goods is well established and lets buyers and sellers trade easily across borders – something Britain’s services-heavy economy misses out on.

■ The hope is CMU should be particularly good for Britain. The UK is home to the biggest financial centre in Europe, and if it is easier to move savings to and from London it should bring more business to Britain.

■ It is intended to be better for savers and borrowers, as each will have more choice.

■ In the US, relatively small firms can access the capital markets, in both equity and debt fundraisings.

■ Brussels hopes to make that possible in the EU, lowering the cost and complexity of reaching investors. Policymakers also hope investors will jump at the chance to access more opportunities directly.

■ The first step is to run the consultation over the next three months.

THE RETURN OF SECURITISATIONS TO EUROPE

Securitisation gained a bad name during the financial crisis, after banks sold bundles of low quality loans with a credit rating – and price-tag – of higher-quality assets.

But the EU wants to reassure investors that the process is a sound way to put their money into productive assets, and can boost lending and growth at the same time. In securitisations, banks sell portfolios of loans on to investors who want exposure to the sector of borrowers.

The sale returns funds to the banks rapidly, allowing them to lend more.

European Commissioner Lord Hill believes that if small business loan securitisations recovered even to only half the level seen in 2012, it would unlock an extra €20bn (£14.7bn) of funding for European banks.

Lawyers welcomed the plan, but noted the EU itself had been an impediment to securitisations since the crash.

“Having unfairly demonised the securitisation industry in the past, this paper represents quite a change of heart for the European Commission,” said Jonathan Walsh from Baker & McKenzie.

“It not only recognises the value of securitisation, but could be a step in the right direction for rebooting the real economy across the board. This is extremely encouraging.”

THE NEW PROSPECTUS

Firms tapping public markets for funds have to issue a prospectus, with details about the company and its plans.

The aim is to give investors full information, but the EU fears different rules in different countries make it very hard to raise funds across borders. It can also be difficult and expensive for small firms to detail all the information. The EU has launched a consultation on plans to simplify the rules.

Investment firm BlackRock said: “In the same way there has been a focus on more targeted narrative reporting in annual reports and accounts, we believe prospectuses could benefit from a similar overhaul.”