Dividends will be key for Royal Mail

Private investors can choose from a wide variety of stockbrokers if they fancy investing in Royal Mail shares

IN THE biggest privatisation since the 1980s, the government plans to sell a majority stake in Royal Mail. Analysts are divided over the attractiveness of the stock – with key details such as share price yet to be finalised – but most expect demand to be high and the sale comfortably over- subscribed.

HOW TO INVEST

There are two options for investors wishing to buy shares in Royal Mail – directly in Post Office branches, or through an intermediary stockbroker. The list of intermediaries is fairly extensive, including Hargreaves Lansdown, The Share Centre, Redmayne Bentley and Beaufort Securities, with many accepting new clients for the sale. Investors can apply for a minimum of £750 worth of stock (£500 for Royal Mail employees).

Gavin Oldham of the Share Centre says that the benefit of applying through an intermediary is that investors “will receive a prospectus and frequent updates on the progress of the listing.” Brokers will also be able to advise on the most tax-efficient way of holding shares. Thomas Mackay-James of Redmayne Bentley says that “higher earners with room left in an Isa should definitely consider adding Royal Mail shares to this.” Dividends paid in an Isa do not incur tax, and this will be especially important given the fact that the company has set aside £133m for payouts next July, with plans for annual £200m dividends in the future. “All the suggestions are that this will be a nice income-paying stock,” says Tom Stevenson of Fidelity.

DIVIDED OPINION

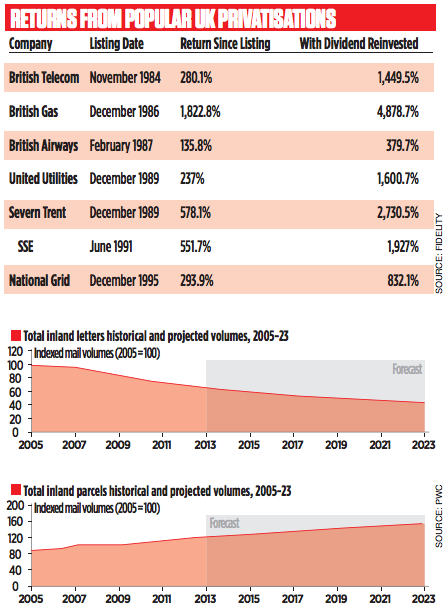

“Reinvesting the dividend from past UK privatisations has proved to be a great decision over the long term,” says Fidelity’s Michael Clarke (see table). Shareholders who reinvested dividends in BT after taking a £1,000 stake in the initial flotation would, by now, have a total investment worth £15,495.

“Concerns remain over the possibility for industrial action at Royal Mail,” says Jason Hollands of Bestinvest, “but most expect this to be priced in to a relatively attractive initial offering.” Moreover, many are optimistic that Royal Mail represents a good play on the growth of online shopping, with parcel delivery potentially offsetting the declining letter business (see table). The group’s most recent annual results showed that revenue from the growing parcel delivery market rose by 13 per cent, with the area now accounting for almost half of revenue. Cantor Fitzgerald’s Robin Byde thinks “this is important given the higher pace of letter decline in the UK – around 4 to 6 per cent compared to just 3 per cent in Germany, for example.” Royal Mail’s impressive physical network of sorting offices throughout the country should help them leverage this, he says.

But according to Paul Taylor of McCarthy Taylor, the international comparison provides a note of caution. “The performance of Deutsche Post shares should worry Royal Mail investors looking for long-term holdings,” he says. The company’s shares were priced at around €23 on its November 2000 flotation, and remain remarkably close to this level today.

Moreover, Deutsche Post has a large logistics business, with the global forwarding and freight component generating over €16bn of revenues in 2013, compared to just over €14bn in mail. Royal Mail, by contrast is “much more reliant on the declining mail revenue stream,” says Taylor. The General Logistics Systems component of Royal Mail contributed around £1.5bn in the last financial year, with letters and parcels combined accounting for over £7.7bn of revenue. “If the government’s valuation is calculated on optimistic future revenue streams,” Taylor says, “we see little long-term scope for a growth in the stock price given the declining letter business and the competitive parcel delivery market it depends on.”

But Oldham says that “companies moving into the private sector are often able to realise considerable efficiency gains in time.” In its mail business, Deutsche Post has a profit margin of 8 per cent – well above Royal Mail’s 3.9 per cent. Belgium’s Bpost, which returned to profitability after the injection of private capital in 2006, now boasts a general profit margin of 17 per cent.

“Ultimately, it depends on the initial price,” Taylor says. “If the government is keen to reclaim revenue to help fix government finances, long-term investors may be disappointed by the scope for share price rises.” The group is expected to be valued at between £2.5bn and £3bn, with the shares to be sold estimated to be worth around £1.2bn in total. Of the total stock, 10 per cent will be reserved for Royal Mail employees.