Darktrace rises on revenue growth and improved forecast

Shares in cyber security company Darktrace jumped over seven per cent on Thursday morning after it recorded a 26.5 per cent growth in revenue and narrowed its full year guidance towards the upper end of forecasts.

The London-listed tech company, which uses artificial intelligence (AI) to provide cyber security services, said revenue for its third quarter was just over $176m (£149m), a year on year rise of 26.5 per cent.

In the three months to 31 March, Darktrace added $29m in new revenue, marking a 6.2 per cent growth when taking currency changes into account. This is the second quarter in a row where they’ve seen an increase in new revenue.

The British company has adjusted their estimate for annualised recurring revenue (ARR) growth, now expecting it to be between 22.25 per cent and 23 per cent, up from their previous estimate of 21.5 per cent to 23 per cent, equivalent to a rise of $2.4m at the midpoint.

Darktrace is also predicting that their revenue for the whole of 2024 will grow by at least 25.5 per cent, slightly higher than their previous estimate of 23.5 per cent to 25 per cent.

The company added 170 customers in the third quarter, with almost 1,000 added since March 2023, taking its client base to a total of 9,402. It comes as demand for cyber security services are soaring, caused by a rise in attacks, especially on businesses.

Darktrace expects revenue from customer additions to increase “once this economic environment,

which appears to have stabilised, begins to improve.”

Cathy Graham, chief financial officer at Darktrace, said: “Following the roll-out of significant Go-to-Market changes in our first quarter, we were very pleased to see the resulting benefits that drove strong second quarter results, continue to accelerate third quarter financial performance.

“Today’s results support our belief that we are seeing a return to positive and sustainable growth and reinforce our view of first half stabilisation and second half re-acceleration. We are pleased to be able to make the resulting upward revisions to our full year guidance as we enter this final quarter of our financial year.”

“Our strong margin and cash generation profile enables us to continue making smart investments in our product pipeline and positioning, Go-to-Market effectiveness and business foundations.

“We believe we are now emerging from a period of relative market uncertainty into a more stable environment, where organisations will prioritise proactive cyber defence to combat attackers who are increasingly exploiting generative AI, automation and cybercrime-as-a-service to increase the speed, sophistication, and success of cyber security attacks.

“With this week’s announcement of the Darktrace ActiveAI Security Platform, we believe we can now better explain the power of our unique approach, and have supplemented our existing best-in-class security products with new innovations and enhanced features to enable proactive cyber resilience in an increasingly challenging environment,” she added.

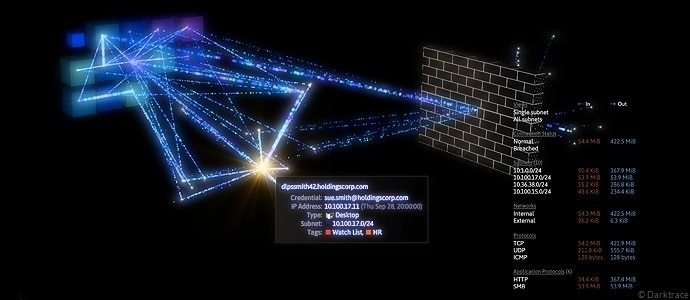

On Tuesday, Darktrace introduced the Darktrace ActiveAI Security Platform, its new product offering which aims to improve cyber resilience by investigating security incidents across a number of applications including cloud, email and third-party tools.

The company also revealed today that none of its three major shareholders, including Mike Lynch’s Invoke Capital, have a right to nominate board directors due to share sales over the past year.