| Updated:

The City of London has its own caliphate – and they have away days in Hampshire

Given what we've learned about caliphates over recent months – largely from the rise of the brutal Islamic State (IS) in the Middle East – the City of London, with its decidedly Western attitudes to money-making, is not where you’d expect to find one.

But it turns out the Square Mile is home to dozens of followers of the world’s largest caliphate, the Ahmadiyya Muslim Community, which currently has over 10 million members scattered throughout 206 countries. It is also the longest-standing caliphate – it was founded by Mirza Ghulam Ahmad in India in 1889 and there have been five leaders since then.

At the end of August the AMC came together in Hampshire, with followers flocking to a field near Alton for three days of prayers, food and mingling while pledging allegiance to their current leader Mirza Masroor Ahmad.

Huge tents were erected to house dining rooms, kitchens, prayer halls and bazaars. The tents were so big, one follower proudly remarked that they had to be imported from Denmark.

As well as learning that the Danes need bigger tents than the rest of us, I found out the Ahmadiyya have been gathering in the English countryside for the past 48 years. But my obliviousness was not shared by the rest of the world – every event has been broadcast to 80 million people all over the world via Muslim Television Ahmadiyya.

Thousands gathered to socialise and pledge their allegiance to the caliph (Source: Makhza-E-Tasaweer)

The word “caliphate” has come to the fore in a negative context recently because of IS, but the AMC describes itself as a “peaceful Islamic movement”. Its founder claimed to be the Messiah prophesised in the Christian, Jewish and Islamic scriptures.

“The caliphate doesn’t have any political ambitions in the way many people view caliphates like IS and Boko Haram,” explains Usman Khan, a follower of the caliphate who works as an risk analyst at a City firm. “We are not like IS – people have the wrong understanding of what a caliphate is.”

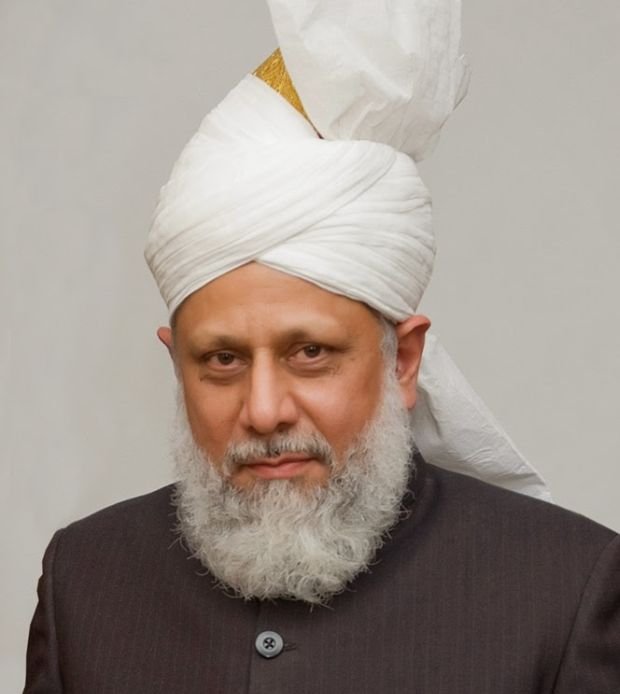

The word literally means a group of people who believe in the religious authority of a successor to the prophet Muhammad. In the case of IS, the notorious Abu Bakr al-Baghdadi is considered to hold this position, whereas in the eyes of the Ahmadiyya community it is Mirza Masroor Ahmad.

Hazrat Mirza Masoor Ahmad became caliph in 2003 (Source: Makhza-E-Tasaweer)

Caliphate in the city

The AMC’s peaceful attitude may explain how it has established itself at the heart of the UK's finance sector so easily, despite carrying the name “caliphate” and all the negative preconceptions that come with it.

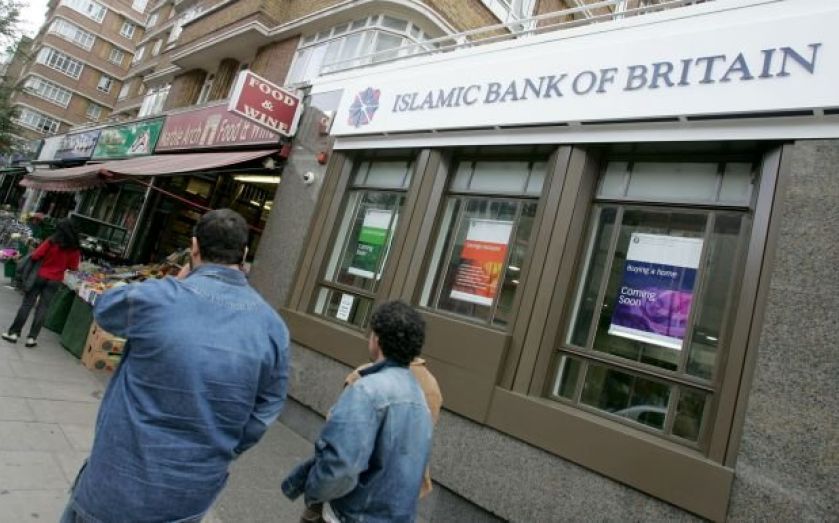

In 2004, caliphate follower Ahmad Salam became one of the founding members of the Islamic Bank of Britain (IBB), but when he first started his career in the city 30 years ago he was one of the few Muslims around. "How things have changed," he says, as he recalls his earliest days in finance.

While the rest of the banking world hits the booze on a Friday after work, they have their own social occasions going on: “There is a growing appetite among members of the caliphate to come together on a Friday. We now have people meeting for prayers at University College London, Canary Wharf, the West End and most recently Shoreditch,” says Salam.

Salam believes the ease with which the caliphate, and Islamic banking in general, have become such an important part of London’s finance sector is in part because of the city’s adaptability to Islamic needs: “Every day I’m in a position where I encounter transactions I can’t take part in, but anything that’s morally questionable I’m not required to – I think the view now is that if you won’t get involved in a particular transaction for moral reasons, you can be excused.”

In particular, Salam regards the setting up of the IBB as having been a crucial step forward for Islamic banking. This, he explains, was the first western-regulated Islamic bank: “I came up with the idea in 2000 and it took four years to work it out with the FSA. We had to get them to allow us to operate Islamic banking alongside conventional banking.

“It was a great thing for the UK to come up with and we have taken a step in the right direction – there is a real desire in this country to understand what Islamic banking is.”

In June this year the UK government issued an Islamic bond, making it the first country outside the Islamic world to take this step. At the time, chancellor George Osborne hailed it as evidence of the “government’s commitment to become the Western hub of Islamic finance”. The bond attracted ten times the number of orders expected.

“While others in the western world resist change, this government is embracing it: banging the drum for British businesses, seeking out new markets, welcoming overseas investment with open arms,” he wrote in the FT.

That being said, the city still hasn't fully accepted all aspects of Islam as a religion, as city worker Saadiyya Khan points out. “Having worked in the city for over 4 years now I still get frequent odd looks from commuters, new colleagues and clients – they just don’t expect to see a hijab wearing woman working in the financial industry in the middle of the city,” she says.

“And I myself have met very few.”