The chips are up for tech pair in £18bn tie-up

THE WORLD’S biggest producer of chipmaking equipment said yesterday it plans to buy out its rival to create a $29bn (£18.1bn) company.

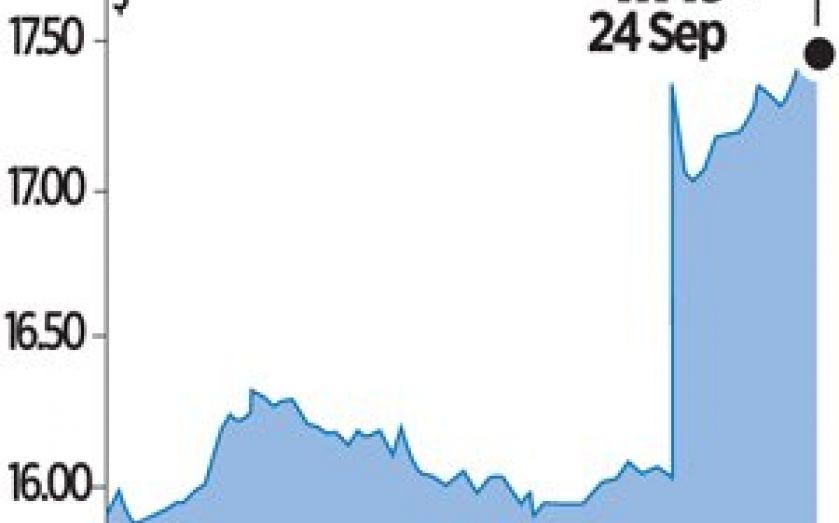

Applied Materials will purchase Tokyo Electron in an all-share deal, the two said.

The surprise move is expected to strengthen their position in a maturing industry where growth opportunities have become harder to find.

“The industry is not high-growth anymore, so you are seeing some consolidation,” David Rubenstein, senior analyst at Advanced Research Japan.

“But both Applied and Tokyo Electron are the best of breed. They have the highest profit margins, they have the best balance sheets, they make money through thick and thin. So they are not desperate but they are hungry for earnings growth and this is one way they can do it.”

Tokyo Electron boss Tetsuro Higashi played down possible anti-trust issues, saying there was limited overlap in their product lineups, although Rubenstein said etching and deposition equipment were areas that might grab regulators’ attention.

Applied Materials chief executive Gary Dickerson will be the boss of the combined company and Tokyo Electron’s Higashi will become chairman. The companies said in a joint statement they would maintain dual listings on Nasdaq and the Tokyo Stock Exchange.