Cadbury sales get a credit crunch boost

Credit crunch-induced comfort eating saw Cadbury beat forecasts with a 46 per cent rise in first-half profits and give an upbeat outlook, shrugging off fears of a consumer downturn.

However, the Dairy Milk chocolate maker warned of possible further cost cuts and job losses as it faces an uncertain economic outlook and further rises in input costs into 2009.

Chief Executive Todd Stitzer said after a 7.3 per cent rise in underlying first-half sales, that full-year growth would be around the top of its medium-term 4-6 per cent range while the operating margin would meet a consensus market forecast of some 11 per cent.

“No matter how bleak economies look, people always go for treats and that’s why we have seen no real slowdown in the first half and we see confectionery as a robust category in difficult economic conditions,” he said.

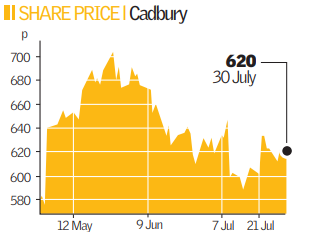

Cadbury shares have been boosted in recent months by takeover talk. But analysts remained divided on whether the sweet maker was still a takeover or merger target.

Numis Securities analyst Ian Kellet said Cadbury’s strong performance alongside the M&A rumours made the stock “very attractive.”

However, Charles Stanley analyst Jeremy Batstone-Carr said M&A was highly unlikely. “The main protagonists, Hershey and Nestle have ruled themselves out,” he said.