Basking in the Coinbase IPO glow, all-time highs litter the boards

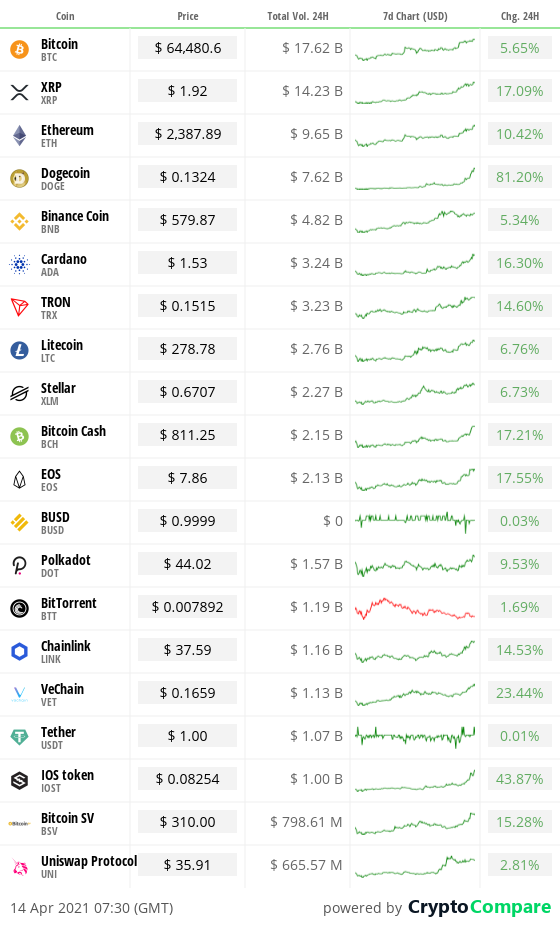

Crypto at a glance

It’s a sea of green today as the Good Ship Cryptocurrency sails on the crest of a wave of all-time highs.

It’s Cheech and Chong time for the crypto markets. The fuse has been lit and we are at the show. Where will it go? Nobody knows.

With Coinbase’s direct listing on Nasdaq kicking off today, almost every coin under the sun is bathing in the warm glow of the notorious ‘Coinbase effect’ – the price bump a coin experiences when it first gets added to the leading US exchange.

Bitcoin is back in uncharted territory, soaring to almost $65,000 this morning. It’s now been trading hands at more than $60,000 for four days in a row and looks to be establishing that level as support. It’s up more than six per cent over the last 24 hours and 11 per cent in the last week. Is there still more to come from the leading cryptocurrency?

There are gains across the board today, though. Bitcoin’s market dominance has actually slipped to 54% despite its recent rise as other coins also show strength, with the total cryptocurrency market capitalisation now sitting above $2.2 trillion. The second-largest cryptocurrency, Ethereum (ETH) has also set a new all-time high of almost $2,400. Can it hit $2,500 today, having only just established itself over the important psychological level of $2,000 at the weekend? It’s now the 36th largest asset in the world, outstripping the likes of Netflix and Adobe. It wasn’t even in the top 100 at the turn of the year.

Perhaps an even bigger question for Ethereum at the moment though is whether it can hold that second spot. Binance’s BNB and XRP continue to see massive gains, rising to $600 and $2 respectively. Even Cardano (ADA) has come storming back into the mix after a quiet couple of months, up 20% over the last 24 hours and currently changing hands at an all-time high of $1.53. Are they now truly ready to give ETH a real run for its money?

Oh, and Dogecoin is up 87%. Because, why not?

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

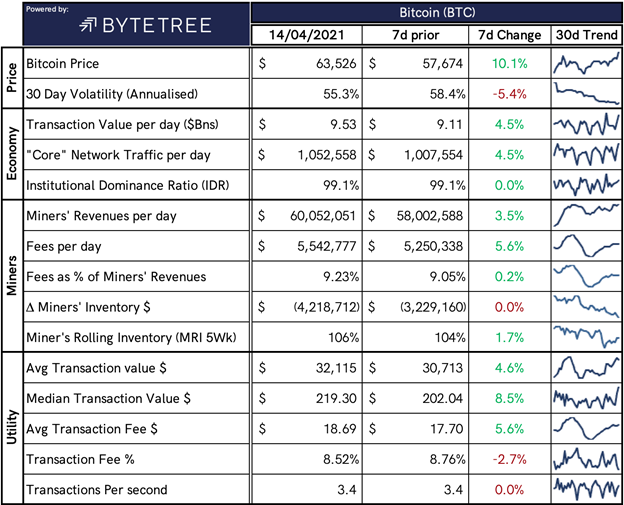

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $2,254,752,578,166, down slightly from $2,096,292,465,523 yesterday.

What Bitcoin did yesterday

We closed yesterday, April 13 2021, at a price of $63,503.46 – up from $59,893.45 the day before. The daily high yesterday was $63,742.28 and the daily low was $59,869.96.

This time last year, the price of Bitcoin closed the day at $6,845.04. In 2019, it closed at $5,096.59.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $1.204 trillion, up from $1.136 trillion yesterday. To put that into context, the market cap of gold is $11.092 trillion and Alphabet (Google) is $1.525 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $74,815,037,858, up from $54,619,615,948 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 44.5%.

Fear and Greed Index

Market sentiment remains in Greed at 75.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 54.78. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 70.50. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“With a sharp debasement of fiat currencies, investors are increasingly losing confidence in savings and are rapidly waking up to the fact that bitcoin is better at being gold than gold. There are many reasons for this. As a digital asset, bitcoin is cost-effective and easier to access than gold in a vault, which leaves investors at the mercy of rising real interest rates. Additionally, bitcoin allows direct access to its owners without dependency on intermediaries like administrators or asset managers, potentially in different jurisdictions.”

Stephen Kelso, head of capital markets at ITI Capital

What they said yesterday

An excellent question…

Oh no, there’s two of them now…

Time for governments to worry?

Or maybe they should just buy…

Crypto AM Editor writes

Intelligence dossier finds Bitcoin is outperforming gold but Ethereum is outshining Bitcoin

Ethereum on a roll as it keeps racking up all time highs

Ziglu makes Tezos and digital coin Tez available to customers

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with Zumo

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special Five Part Series

March 2021

Day Five

Day Four

Day Three

Day Two

Day One

Crypto AM: Recommended Events

AIBC World

May 25 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021 (announcement soon)

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.