Barratt: Rising mortgage costs could hit its profits as house prices slide

Barratt Developments said the outlook for 2023 was ‘uncertain’ as rising mortgage costs force residential property sales down.

The FTSE 100 listed house builder said demand for its homes in 2023 looks “uncertain” due to prospective home buyers shunning big ticket purchases amid a cost of living and mortgage affordability squeeze.

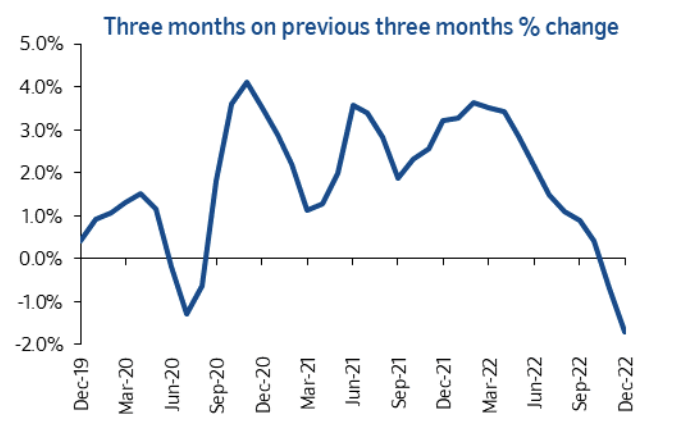

Mortgage costs have been climbing following the Bank of England’s series of interest rate hikes, a move that analysts believe will send house prices sliding in 2023.

The warning provides further evidence the UK property market is on a downward trajectory in 2023.

Latest house price indexes from Nationwide, Halifax and Zoopla have all revealed property prices are falling. Some experts reckon they could tumble around a fifth this year.

“The outlook for the second half of [full year 2023] is uncertain with homebuyer confidence and the availability and competitive pricing of mortgages critical to the health of the UK housing market in the coming months,” Barratt said in earnings covering the six months to last December.

It will publish its interim results on 8 February.

While that effort should help cool price rises, it has made mortgages much more expensive. According to data provider Moneyfacts, the average rate on a 2-year fixed mortgage has doubled over the last year to 5.79 per cent.

Those higher borrowing costs have also trimmed Barratt’s purchase pipeline. It said forward sales of its homes collapsed nearly a third to £2.54bn over the last year.

David Thomas, chief executive of Barratt Developments, said: “The first half of the financial year has however seen a marked slowdown in the UK housing market. Political and economic uncertainty impacted the first quarter; this was then compounded by rapid and significant changes in mortgage rates which reduced affordability, homebuyer confidence and reservation activity through the second quarter.”

A wave of homeowners are set to remortgage over the next couple months, possibly prompting houses to be dumped on the market due to them being unable to afford higher bills.

The ONS reckons nearly 800,000 Brits’ mortgage bills will double this year.

Despite the slimmer pipeline, Barratt built 6.9 per cent more homes in the six months to December compared to the previous half year. Average selling price for its properties also jumped more than 14 per cent to £330,000.

The firm’s shares dropped 0.5 per cent in the morning session today, sending it to near the bottom of the FTSE 100.

Fellow house builder Persimmon updates markets tomorrow and is expected to suffer a similar fate to Barratt.