The World Bank’s 3 big fears for 2014

The World Bank's latest report on Global Economic Prospects is out today, and while advanced economies are expected to boost global growth in 2014, the authors reveal some worrying downside risks from emerging markets.

1. Rocky road as global interest rates rise

The Bank is worried that a “more precipitous adjustment” in rates could “inflict significant damage on developing economies” with major trade deficits.

The report's central forecast is for a squeeze on these countries in the next couple of years, but the downside risks to the forecast make for grim reading:

Should market reactions to the withdrawal of extraordinary monetary measures in high-income countries be less orderly than assumed in the baseline… capital flows to developing countries could decline by 80 per cent or more for several months – potentially sparking local crises in countries with large external imbalances

2. Financial instability in east Asia

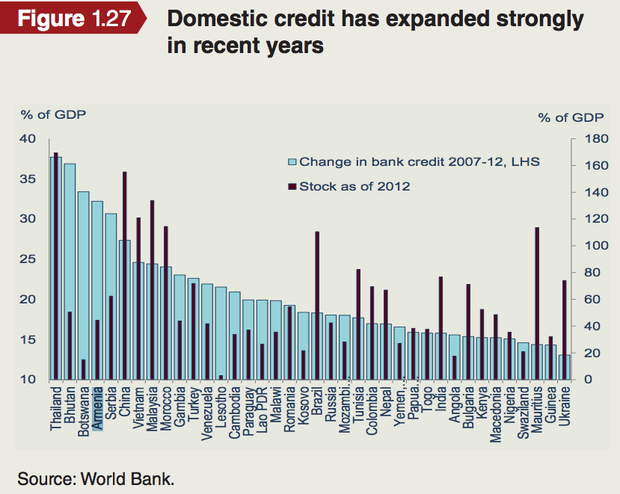

Huge expansions in credit for many countries in east Asia are mentioned as another potential issue in 2014.

Credit stock has risen from 150 to 210 per cent of GDP since 2007 in China, and big increases have been recorded in Malaysia, Vietnam, Thailand and Indonesia. The Bank is concerned that rate pressure may produce instability in these rapidly expanding credit markets.

3. Developing countries have no more time to delay reforms

Elections in many of the countries that strained to deal with the market reaction from taper talk during the summer roll round this year – Brazil, South Africa, Turkey, Thailand, India and Indonesia all go to the polls.

The forecasters fear that these political pressures may make reforms for stability and growth more difficult, and some countries would be unprepared for further tightening.

Indications of policy complacency also appeared once financial market pressure subsided after the summer sell-off. Although there have been positive developments, credit continues to expand too quickly in several of the countries hardest hit by markets during the summer, a factor that may be adding to vulnerabilities.