Why lockdown winners are not vaccine losers

The past year has brought significant changes to all our lives and sped up the growth of a number of consumer and leisure trends. Online shopping is an obvious example and the same is true for some of the other “lockdown winners”: namely computer games and cook-at-home meal kits.

Like online shopping, we think these are two trends that are here to stay and can continue to grow beyond the pandemic. What’s more, we think smaller companies are the best way to access the investment opportunity.

The future of gaming

Computer games continue to evolve very rapidly. The pace of change over the last forty years has been incredible and innovation continues to come through. Gaming is associated with lockdown in some investors’ minds but that ignores the enormous potential for structural growth in the sector.

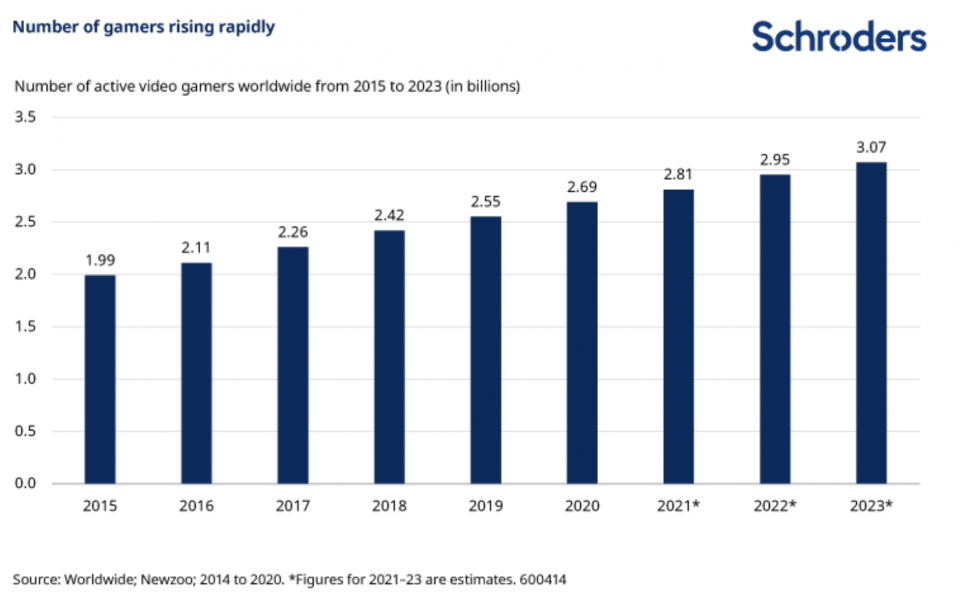

We’ve seen huge numbers of people take up video gaming. Data from Statista shows the number of gamers worldwide rising from just under two billion in 2015, and predicts this to rise above three billion in 2023.

We’ve seen games evolve so that they’re as much about socialising as the game itself. MMO (Massively Multiplayer Online) games allow large numbers of players to participate, creating a community feel to the game. They also harness a sense of story-telling that keeps players interested.

Then there’s the ongoing innovations in e-sports and virtual reality. E-sports (electronic sports) have been growing in popularity not just in terms of participants but also in drawing a fan base who attend real life tournaments and watch online. The 2019 League of Legends World Championship drew over 100 million viewers, the same as the Superbowl. In the past, computer game companies had looked at tournaments primarily as marketing tools to help retain customers but they are increasingly becoming important in terms of monetisation too.

Discover more from Schroders:

– Learn: Are any stocks cheap in early 2021?

– Read: Taper Tantrum 2: Is there a sequel in the making?

– Watch: Will 2021 be the time for investors to stop hibernating?

There are a number of European companies at the forefront of these developments. Assassin’s Creed publisher Ubisoft Entertainment is perhaps the best known. However, for investors in smaller companies there is a wide range to choose from: Embracer, Stillfront, Team17 and Nacon are also European developers of popular titles.

Sweden in particular continues to be a leader in video game development. Popular games such as Minecraft and Candy Crush were developed in Sweden; industry body Dataspelsbranschen says one in eight people around the world has played a game made in Sweden. Last year’s bidding war between Electronic Arts and Take-Two Interactive for UK firm Codemasters illustrates how small European firms have unique capabilities that are attractive to the big US game developers.

From an investment standpoint, the potential for monetising the popularity of video games is very exciting. Pricing has largely stood still in recent years but that’s starting to change. Many games are free to download and rely on in-game purchases for revenues. Even the purchase of a physical game, at around £50, compares favourably with other types of entertainment given the amount of time generally spent on completing a game.

However, there are risks that investors need to take into account. The increasingly high profile nature of the industry means a game release that goes wrong will be noticed. Late last year, Sony pulled the hotly-anticipated Cyberpunk 2077 from its store, following user complaints about glitches, with Microsoft also offering refunds. The developer of the game – CD Project Red, which traditionally focused on the PC gaming market – had to patch the game for consoles.

Investors need to be mindful of such risks. Careful research into a business’s experience of different gaming segments – PC, console, mobile – is required. Spreading investments across a number of companies may be one way to try to manage the risk. There is also an opportunity to invest in outsourcing companies who provide quality assurance, testing, and translation services for computer game developers. Such services may be increasingly in demand as consoles eveolve and consumer expectations rise.

The future of meal kits

Another lockdown hit has been meal kit deliveries. Lockdown and working from home means people have been preparing more of their own food than ever and many are becoming bored of their own cooking. Meal kits have proved a popular solution and are another lockdown habit that we think will endure.

The market leader, HelloFresh, had 5 million active customers in Q3 2020 who ordered 162 million meals. This compares to 2.6 million active customers and 68.9 million meals in the same period of 2019.

With much of Europe still in lockdown, many of us are looking forward to going out again to restaurants when we are able to. But that could be as well as, not instead of, ordering a meal kit.

Such kits were already growing in popularity before the pandemic among time-poor, health conscious consumers. Meal kits provide fresh ingredients and recipe cards, tailored for a specified number of people. This appeals to a customer base that is aware of the importance of fresh food when it comes to health as well as the environmental impact of food waste.

The pandemic, with its restaurant closures and supermarket queues, led many people to discover meal kits for the first time. However, there is considerable potential growth ahead, in our view. The market currently mainly targets dinners but there is scope to move into lunches, breakfasts and snacks. Then there is the prepared food market, which HelloFresh recently entered in the US by buying Factor75.

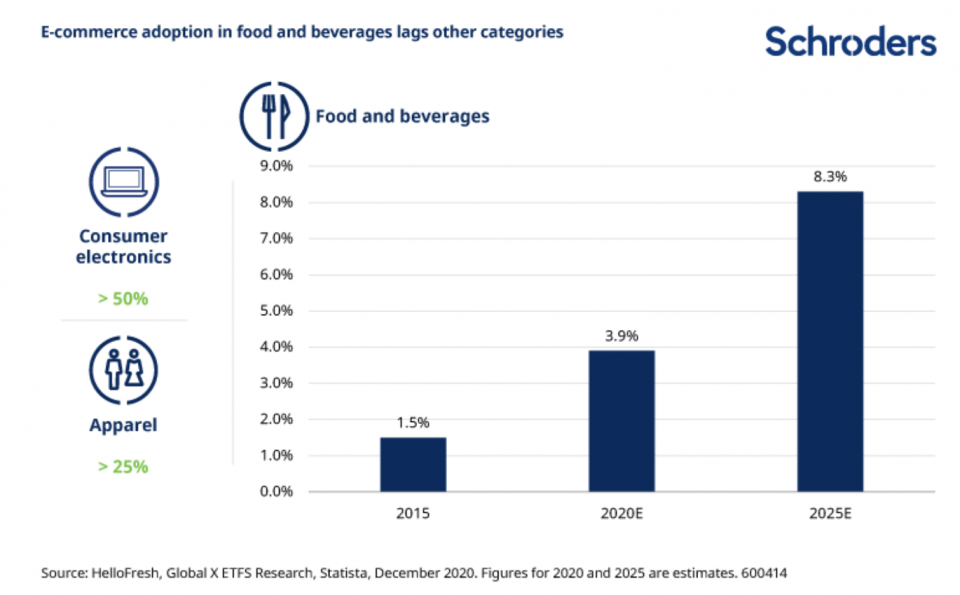

Indeed, while the pandemic saw sharp growth in food e-commerce, that growth came from a low base and still lags far behind other categories, such as clothing. The potential for further growth is significant, in our view.

As with any online business, meal kit providers’ first task is to make their brand known to potential customers, which involves significant marketing spend. The key issue for us, as investors, is to find the companies that can grow and make a profit, rather than simply chasing volumes. Again, careful research is needed to find the winning businesses.

High customer churn is another risk to be aware of – many people take advantage of discounts to try a meal kit for a week or two but don’t sign up for the longer term. The crucial point for a supplier is to ensure service quality is high, so that customers who have had a good experience will return when it better suits their budget or lifestyle.

Much of Europe remains in some form of lockdown for now. When the pandemic does lift there will be stocks in currently closed sectors – travel, hospitality – that will benefit. But we think computer games and meal kits will prove to be two lockdown habits that will stick.

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.