Why don’t London’s luxury hotels make any money?

London is home to some of the most iconic and well-known luxury hotels in the world.

The Savoy, the Ritz, The Dorchester and Claridge’s, to name just a few, are renowned the world over and have played host to the ultra wealth, celebrities and royalty.

Also appearing in a string of popular films, London’s luxury hotels have become part of the crown jewels of the capital’s luxury scene.

But scratch the gilded surface, and the financial performance of some of these iconic names doesn’t match up to the glitz and glamour seen from the outside.

Recent public filings have revealed a number of London’s most famous luxury hotels are continuing to make sizeable losses as they prove to be as immune to wide industry and economic challenges as much less well known competitors.

Below, City AM takes a look at how well London’s luxury hotels have been performing in recent years and explains why the likes of The Savoy, the Ritz, The Dorchester and Claridge’s are failing to turn a profit.

The economic context

Just because the name above the hotel door is known and revered across the world, doesn’t necessarily mean the business is insulated from the economic challenges facing all companies in the UK at the moment.

Rising labour costs, especially since the increase in the National Minimum Wage and employers’ National Insurance contributions, are frequency cited as major weights on hotels’ balance sheets.

The long-time factor of growing utility and energy costs as well as food and beverage inflation are also consistently named as challenges for the wider hotel industry.

An increase in the competition has also not helped the financial performance of London’s most established named – with more luxury bedrooms becoming available in recent years.

Oversupply can lead to downward pressure on room rates, occupancy levels and increased marketing costs and discounting.

Luxury hotels in any major city, and London is no exception, depend heavily on international, high-spending travellers.

With recent fluctuations in global economic conditions and exchange rates, a fall in inbound tourism has a higher impact on luxury hotels than a lot of other businesses.

The Savoy Hotel

A series of recent public filings have laid bare the continued struggle for some of London’s top hotels to post a profit.

A good example of The Savoy Hotel which has not posted a pre-tax profit since 2006. Since then, the hotel has lost more than £554m.

In its latest set of accounts, the hotel made a pre-tax loss of £19.6m for 2024, having also lost £17.5m in 2023.

Its revenue also fell from £63.3m to £59.7m over the same period.

A major mitigating factor for its latest set of accounts was the phased refurbishment of its guest rooms and the Gallery restaurant which started in August last year.

The hotel also paid £26m in interest to related parties in 2024, down from £27.8m, as well as £2m in management fees.

The Savoy Hotel is partly owned by Kingdom Holding Company in Saudi Arabia, Fairmont Hotels and Resorts and Katara Hospitality, which is owned by the government of Qatar.

Therefore turning a profit might well be looked on as a lower priority than just simply holding onto one of London’s most iconic luxury hotels.

The Dorchester

Like The Savoy Hotel, The Dorchester is owned by an extremely wealthy organisation which makes turning a profit less of a pressing matter.

In this case, the hotel and the wider group it is a part of is owned by the Brunei Investment Agency, an arm of the Ministry of Finance of Brunei.

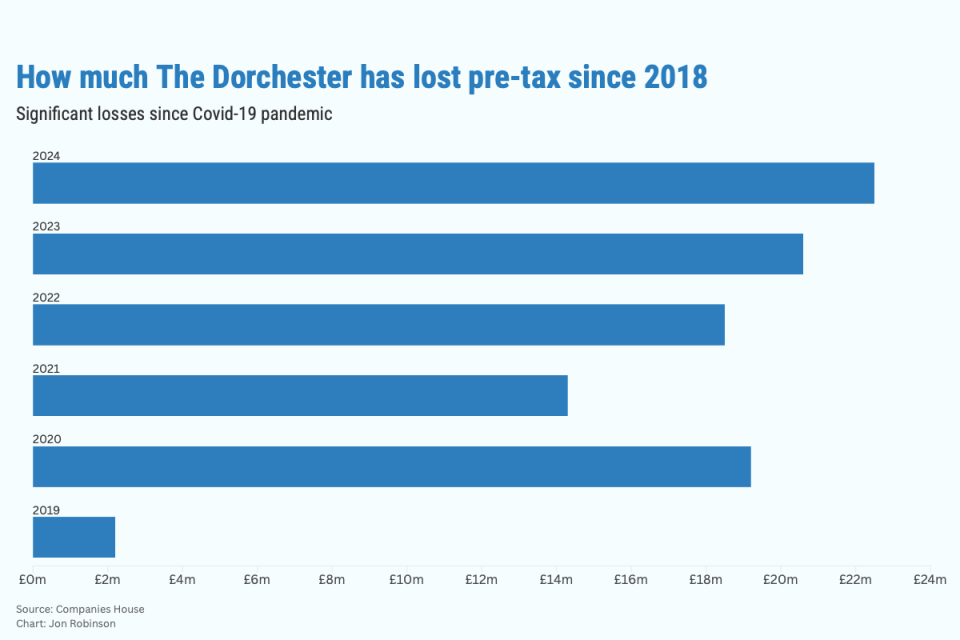

And also like The Savoy Hotel, The Dorchester’s pre-tax loss widened from £20.6m to £22.5m in 2024.

The hotel has not made a pre-tax profit since the £8.2m it achieved in 2018.

In its latest set of accounts, The Dorchester Hotel said its trading performance had fallen short of its budget “due to the impact of its refurbishment and delay in the return of room inventory”.

It should also be noted that the hotel’s revenue increased from £67.6m to £73.7m in the year.

But its finance costs did almost double from £7.5m to £14.4m in 2024.

But while The Dorchester itself remains in the red, its parent group returned to the black in 2024.

That group includes Hotel Plaza Athenee and Le Meurice in Paris, Hotel Principe di Savoia in Milan, Hotel Eden in Room, Hotel Bel-Air and The Beverly Hills Hotel in Los Angeles.

Claridge’s back in the red

More major redevelopment work also significantly impacted the financial performance of Claridge’s in 2024.

The hotel slipped into the red despite its revenue rising in the year as the work was carried out.

New filings with Companies House recently revealed that it fell to a pre-tax loss of £5.4m, down from the £7.2m pre-tax profit it achieved in 2023.

However its revenue rose over the same period from £119.3m to £136.9m.

The hotel’s bosses cited rising inflation and interest rates, energy costs, supply chain constraints linked to the post-pandemic recovery and the ongoing war in Ukraine and Palestine as major factors behind its loss-making year.

They also warned that “macroeconomic factors including political and economic instability mean that forecasting 2025 and 2026 performance remains challenging”.

The hotel’s net finance costs also grew from £27.8m to £31.9m in 2024.

Claridge’s is owned and managed by Maybourne Hotel Group whose Qatari ultimate beneficial owners are Hamad bin Khalifa al-Thani, the former emir of Qatar, and the former prime minister Hamad bin Jassim bin Jaber Al Thani.

The Ritz makes fifth consecutive loss

Arguably the most famous luxury hotel in London, The Ritz made a loss for the fifth year in a row despite its turnover jumping in 2024.

The Ritz reported a pre-tax loss of almost £3m for its latest financial year, down from the £10m loss it posted for 2023.

The Ritz also made a loss of £16.5m for 2022, £32m in 2021 and £27.3m in 2020.

The last time the hotel reported a pre-tax profit was the £2.4m it achieved in 2019.

But while its loss-making streak continues, the hotel’s turnover increased in 2024 from £36m to almost £43m.

The Ritz was acquired by Qatari tycoon Abdulhadi Mana Al-Hajri from the billionaire Barclay brothers for around £700m in March 2020.

Future results could provide welcome boost

It also remains to be seen how The Lanesborough, which is located on Hyde Park Corner, fared during 2024 as its latest accounts are overdue to be filed with Companies House.

In 2024, City AM reported that the hotel’s pre-tax loss widened from £11.2m to £15m as its valuation reduced by CBRE from £255m to £241.6m in 2023.

The Lanesborough is ultimately owned by the Abu Dhabi Investment Authority.

The latest results for the Shangri-La Hotel at The Shard could also provide a boost for London’s luxury hotel industry.

The hotel has previously said it was eyeing an improvement in its financial performance in 2024 despite its pre-tax loss widening in 2023.

Its pre-tax loss went from £6m to £7.3m in 2023 despite its turnover rising from £45.8m to £49.2m over the same period.

Autumn Budget relief?

With just over a month to go, attention is turning towards the Treasury and what Chancellor Rachel Reeves could include in her second Autumn Budget.

Last year’s tax hikes for UK businesses has been cited as major drags on growth plans and it is now accepted that more increases are coming on 26 November.

However, Reeves could include a number of measures in the Budget which might provide some relief for London’s luxury hotel industry.

The much talked about business rates reforms could lessen the cost pressures facing businesses or temporary reductions in VAT for accommodation providers could be on the cards.

But whatever the Chancellor announces next month, it is expected to take some time yet for London’s top luxury hotels to all return to profit.