UK unemployment: 612,000 workers lose jobs as vacancies crash to record low in lockdown

The UK unemployment rate unexpectedly remained unchanged in the three months to April, but workers on company payrolls fell 612,000 between March and May while job vacancies plunged to a record low.

The unemployment rate remained unchanged at 3.9 per cent between February and April, new data from the Office for National Statistics (ONS) showed. That surprised economists, who had predicted the figure to increase as coronavirus lockdown measures hammered the economy.

Read more: Number of workers on UK furlough scheme nears 9m

Vacancies slump as 600,000 enter unemployment

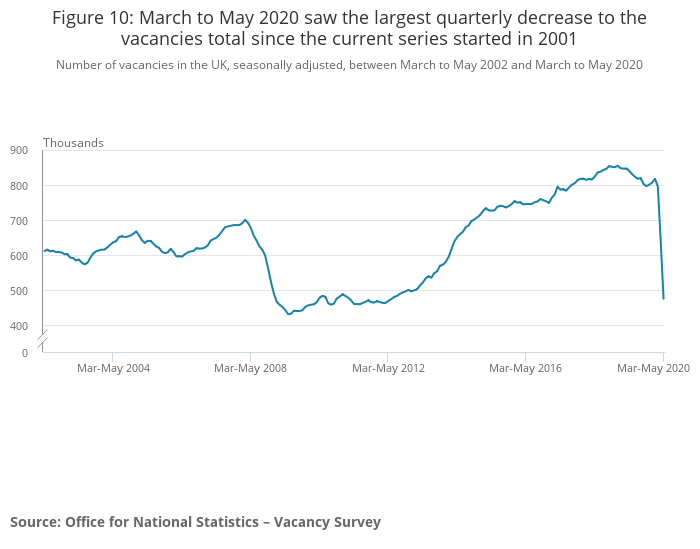

But between March and May, the UK recorded the largest quarterly decrease in job vacancies since records began in 2001.

During the period there were an estimated 476,000 vacancies in the UK – 342,000 fewer than in the previous quarter.

The number of people on company payrolls fell by 612,000 or 2.1 per cent between March and May as lockdown continued to hurt the labour market.

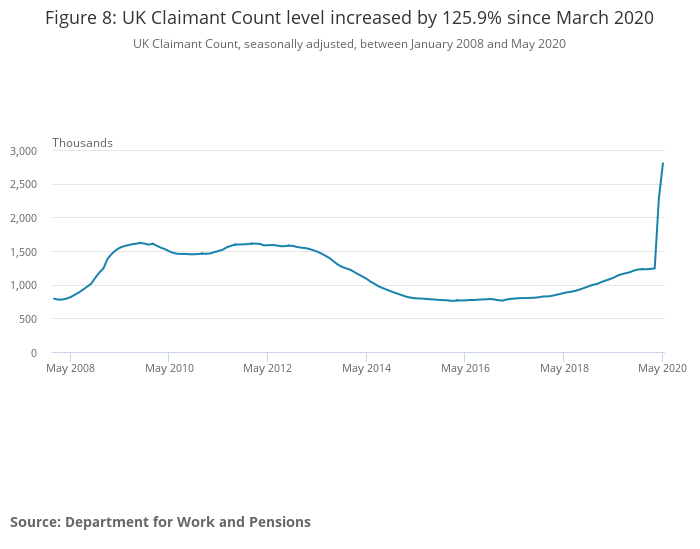

The jobless claimant count increased in May to 2.8m – a monthly increase of 23.3 per cent. Since March 2020, when lockdown began, UK jobless claims have increased 125.9 per cent or 1.6m.

Economists question speed of UK recovery

Minister for employment Mims Davies said today’s UK unemployment data shows how badly coronavirus has hit the economy.

“But our furlough scheme, grants, loans and tax cuts have protected thousands of businesses and millions of jobs, setting us up for recovery,” she added.

But economists questioned how quickly the UK economy can recover, saying the little-changed unemployment rate fails to show the huge extent of furloughing.

PwC senior economist Jing Teow pointed out the lack of movement in the UK unemployment rate fails to account for the 8.9m workers on the government’s furlough scheme in May.

That number surpassed 9m in June, separate data out today revealed.

“Today’s data shows just how hard the coronavirus has hit workers across the country,” Teow said. Economists fear a spike in the UK unemployment rate when furloughing ends in October.

Self-employed numbers sink as hours crash

The three months to April also saw a record quarterly fall in the number of self-employed people in the UK, which decreased 131,000.

The number of hours worked between February and April crashed 8.9 per cent or 94.2m – a record annual decrease, despite only half the period covered being affected by coronavirus lockdown measures.

Furlough scheme stops UK unemployment spike

Pantheon Macroeconomics’ Samuel Tombs said data showed he government’s coronavirus job retention scheme “has succeeded in preventing massive job losses so far”. But he said it meant the unemployment rate has been kept “in suspended animation” as those on furlough are not counted as unemployed.

Tombs warned that “a second wave of redundancies remains likely when financial support for employers who furloughed workers is wound down between August and October”.

Before the Open newsletter: Start your day with the City View podcast and key market data

The UK unemployment rate had been widely expected to drop between February and April, but instead remained unchanged month-on-month. Year-on-year, the unemployment rate rose 0.1 percentage points.

The ONS estimated that the UK employment rate was 76.4 per cent, 0.3 percentage points higher than a year earlier but down slightly from the previous quarter’s record high of 76.6 per cent.

Jobless rate set to surge as furlough ends

“The furlough scheme continues to hold off the bulk of job losses, but unemployment is likely to surge in the months ahead,” said Tej Parikh, chief economist at the Institute of Directors.

Read more: We must be ready for further stimulus, says Bank of England’s Andrew Bailey

“Wage support has given firms some much-needed time to regroup,” he continued. “Despite these efforts, activity will inevitably be below normal for some time as social distancing continues, and employment looks set to take a hefty hit. Salaries and vacancies are also likely to keep falling as businesses aim to keep costs down.”

“As many as a quarter of firms have said they will struggle to pay anything toward furloughed workers’ pay come August. More bad news could be just round the corner, as redundancy consultation periods kick in,” Parikh added.

Furloughed worker numbers hit wage growth

“The sharp fall in weekly hours worked, close to nine per cent compared to last year, offers a truer picture of the impact of rising unemployment and furloughing,” PwC’s Teow added.

Real pay fell 0.4 per cent between February and April – its first drop since January 2018 – while vacancies collapsed by a record 60 per cent between March and May. Jobless claimants rocketed to 2.8m.

Teow said the UK economy’s prospects depend on how many businesses emerge from furlough and lockdown intact.

“The tapering of the furlough scheme from August, with a portion of the wage bill needing to be picked up by the private sector, could hit many businesses hard,” he added. “Some furloughed workers may not have jobs to return to when this is over, which could put a dampener on the recovery.”

And Howard Archer, chief economic adviser to the EY Item Club, said: “The labour market weakened further in May – although it is clear that the impact of the lockdown on jobs has been limited by companies’ ability to furlough workers under the government’s Coronavirus Job Retention Scheme.”

He also warned the sheer number of furloughed workers, being paid 80 per cent of their salaries, has dragged down average wages.

Sign up to City A.M.’s Midday Update newsletter, delivered to your inbox every lunchtime

“Annual earnings saw a further decline in growth in April and they look set to weaken further over the coming months,” he said.

“Even before the impact on earnings from Covid-19, earnings growth had come well off the highs seen in mid-2019,” he added.

Average earnings growth had peaked at four per cent in May 2019, but by March it had sunk to 1.2 per cent, then just one per cent in April.