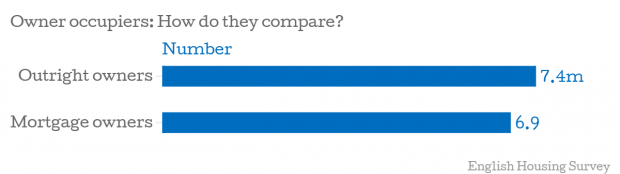

UK property market: Number of mortgage-free homeowners now outstrips those with property loan

The number of people in the UK who own their home outright has surpassed the number of those with mortgages for the first time since the 1980s.

Of the 14.3m who own their house, 7.4m owned outright, compared to 6.9m who bought with a mortgage. Last year these two types of owner were equal, according to the latest official figures.

Homeowners account for 63 per cent of all housing in the UK, a decline from the peak of homeownership in 2003, when it stood at 71 per cent.

This has been mirrored in the boom in the private rented sector, which has doubled in size since 2002, now accounting for 19 per cent of, or 4.4m, households, according to the English Housing Survey report.

UK tenures

Over-65s make up the majority of households without a mortgage, accounting for 4.5m of the 7.4m outright owners.

Meanwhile, the number of homeowners aged 25-34 years old, either owning outright or with a mortgage, fell from 59 per cent to just 36 per cent in the last decade, demonstrating the generational divide when it comes to property ownership.

In London, the number of outright homeowners is the lowest of all tenures. The private rented sector remains the largest type of household, followed by those bought with a mortgage and then social renters.