UK productivity improves significantly in second quarter

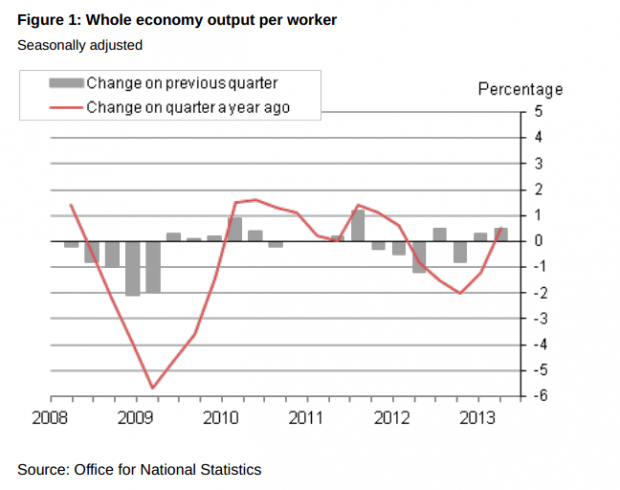

The graph shows whole economy output per worker in terms of percentage changes on the

previous quarter and on the previous year.

Based on output per hour, UK labour productivity went up 0.5 per cent in the second quarter of 2013, having been flat in the first quarter. This was the first quarter on quarter increase since the second quarter increase in 2011. (Release)

Over the same period, reports the Office of National Statistics (ONS), market sector productivity increased by 0.6 per cent. The manufacturing sector saw output per hour increase by 0.7 per cent; output per hour in the service sector increased by 0.1 per cent and there was a 1.1 per cent rise in the broader production sector. Nonetheless, output per hour worked was still down 0.4 per cent year-on-year in the second quarter.

Whole economy real (inflation adjusted) output rose in the second quarter, while employment and hours rose at a lower rate. Labour productivity has, therefore, gone up in all areas for the period.

Output per worker rose 0.5 per cent quarter-on-quarter in the second quarter, following an increase of 0.3 per cent quarter-on-quarter in the first quarter. Output per worker was up 0.5 per cent year-on-year in the second quarter, which was the first annual gain since the first quarter of 2012.

Unit labour costs increased sharply over the period, but a large proportion of this increase was down to a significant rise in the level of bonus payments made during April.

On growth in the manufacturing and services sectors, the ONS says:

In the manufacturing sector, weakening output growth since 2011 has been accompanied by a pick-up in employment and hours, and productivity has therefore fallen significantly during 2012. While hours worked rose very slightly in the second quarter of 2013, the number of jobs is estimated to have fallen by 0.5%, and output per job has therefore continued to recover in the second quarter. Manufacturing output per hour remains below the level seen in the second quarter of 2012 but output per job is now above the same quarter of 2012.

Output in the services sector has been growing at between 1% and 2% a year since the start of 2011. Employment and hours grew more slowly than output for much of this period, but hours picked up significantly during 2012, and this was followed by faster growth in the number of jobs. Productivity therefore weakened in 2012, although it rose a little in the first quarter of 2013 and was little changed in the second quarter as GVA, the number of services jobs and hours all grew broadly at the same rate.

Howard Archer of IHS Global Insight comments on the improvement of the results:

[The results give] hope that much of the recent weakness has been cyclical and productivity can improve appreciably as the economy recovers. The real test on productivity will not come though until the UK has seen an extended period of at least reasonable growth.

There continues to be sharp debate and much uncertainty over how much of the UK’s poor productivity performance since the 2008/9 downturn is due to cyclical factors and therefore likely to be temporary, and how much is due to structural factors and therefore likely to be long-lasting or even permanent.

The extent to which the weakness in the UK’s productivity has been structural rather than cyclical has vital implications for the economy’s growth potential and for policy. Particularly relevant at the moment, the Bank of England is assuming that productivity will pick up appreciably as UK recovers with the result that the unemployment rate will come down gradually. This is a key factor in the Bank of England’s view that the unemployment rate will not come down to 7.0% before mid-2016 with the result that it is unlikely to raise interest rates before then.

If much of the weakness of productivity is cyclical, then it clearly should improve markedly as the economy recovers.

An element of the UK’s poor productivity performance does appear to have been companies’ willingness to hold on to workers, particularly when the workers are skilled or experienced. There have also been reports that some companies employed more people, or at least retained workers, as they found winning and delivering work more resource intensive in an environment of persistently weak demand. For example, extended weak housing market activity clearly hit the productivity of estate agents as it is took them longer to sell a house.

These factors would all partly explain the recent poor productivity performance, and would support belief that productivity will pick up as the economy improves.

The more significant these factors are, the more likely it is that productivity will pick up as economic activity strengthens.