UK industrial production flat, as shares fall across Europe on German data

After industrial production tumbled in Germany, the data was flat for the UK.

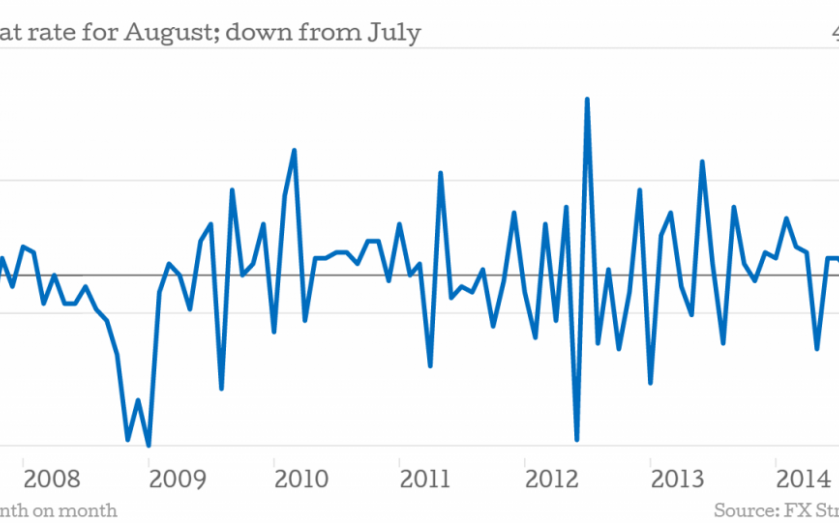

Month-on-month figures showed a rise of 0.1 per cent, down from 0.5 per cent in July.

Earlier this morning Germany had reported the biggest month-on-month drop in output since January 2009.

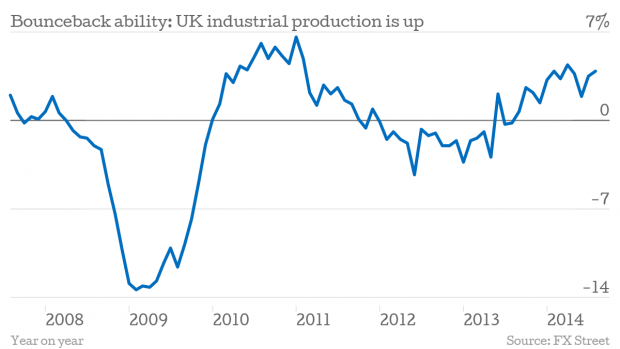

Taken as a whole, it hasn't been a bad year for the UK's manufacturing industry. Year-on-year growth topped analysts expectations by 0.5 percentage points, coming in at 3.9 per cent.

However, the slowing of domestic demand and the struggling Eurozone have built a bit of resistance for the recovery. Not enough to derail it, though, according to economists at Berenberg:

Years of relative decline mean the manufacturing sector now accounts for only around a tenth of UK output. This latest headwind will slow British GDP growth a little rather than a lot; we think to 0.6 per cent qoq in Q4 from 0.9 per cent in Q2.

Berenberg also said that, although events overseas were affecting the UK, other sectors of the economy should keep the recovery on track:

Domestic demand should keep the recovery strong. While UK domestic demand has lost a bit of steam in recent months, the latest PMIs still signal that strong services and construction growth should continue while manufacturing suffers from events overseas. The risk to our call comes from the possibility that slower growth overseas and geopolitical tensions hit investment intentions in the UK as they have done in Germany.

The risk to our call comes from the possibility that slower growth overseas and geopolitical tensions hit investment intentions in the UK as they have done in Germany.

The data also shows the recovery is not yet complete:

From the ONS report:

Compared with the pre-downturn GDP peak in Q1 2008, in the three months to August 2014, production was 9.6 per cent lower and manufacturing was 4.4 per cent lower.

Earlier today, Germany's data showed a four per cent monthly drop, and European shares followed the data over the edge.