UK house price growth slows again: Can stamp duty save the market in 2015?

We know the drill by now – slowing house price growth in many areas as demand wanes and the murmurings about a base rate rise reflect the logic that no matter what, it’s getting closer.

Why exactly demand is waning remains something of a mystery (more of that later).

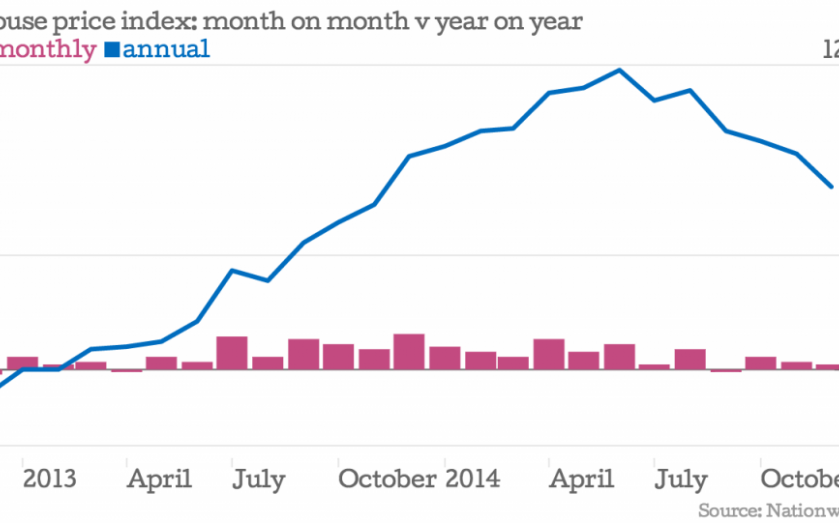

Nationwide’s figures this month are more of the same: a 0.2 per cent rise in December (down 0.1 of a percentage point from a similarly lethargic 0.3 per cent in November) bringing the rate for the year to 7.2 per cent. It seems so long ago that the rate was fuelling fears of overheating in June, when it hit 11.8 per cent (see graph above).

The rate of growth has now been falling for four consecutive months, and mortgage approvals are at their lowest level for 16 months. The average price in the UK is now £188,559, according to Nationwide, a drop from November’s average of £189,338.

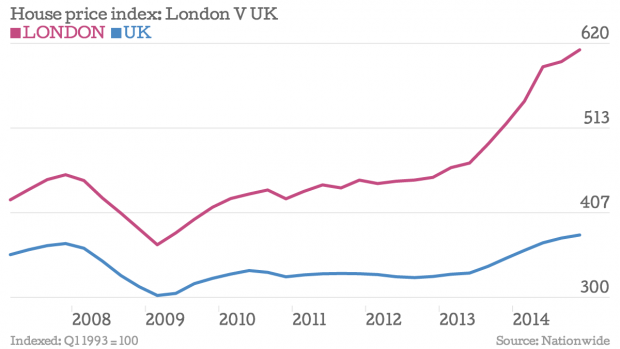

London, the powerhouse of the market, is cooling too – although Nationwide doesn’t see this as the main reason for the slowing of prices. After all, London has still posted robust growth figures of 17.8 per cent for the year to the fourth quarter.

What is more, London's growth was faster in the fourth quarter than it was in the third (2.5 per cent in the fourth quarter compared with 1.1 in the third), and most regions are still growing, many faster than CPI inflation of one per cent.

What of 2015?

The real questions then are what to expect in 2015. Robert Gardner, Nationwide’s chief economist, highlights the complex evolution we are watching:

The slowdown in housing market activity is surprising given further steady gains in employment, a pickup in wage growth (albeit from low levels) and the continued low level of mortgage rates. Moreover, surveys suggest consumers remain in high spirits – a view reinforced by robust retail spending growth in November, which was at its highest for over a decade.If the economic backdrop continues to improve as we and most forecasters expect, activity in the housing market is likely to regain momentum in the months ahead.Supply side developments will be crucial in determining the trajectory for prices. There are encouraging signs that construction is starting to pick up. Hopefully, this will set the stage for house price growth gradually converging with income growth in the quarters ahead.

And construction needs to pick up. A survey released by the National Association of Estate Agents showed that many of that body’s members believe that there will be falls in the level of supply, while even the optimistic ones believe supply will remain a fair way behind demand. That’s a net deficiency however you want to package it.

Stamp duty

If there is a game changer, it could be stamp duty. Data from the Land Registry suggests that 590,000 people could benefit from the change announced at the Autumn Statement, which replaced the antiquated slab system.

The old framework used a series of seemingly arbitrary thresholds beyond which all sales are taxed the same until the reach the next threshold. This led to sales clustering below the points at which stamp duty would jump. The new, more progressive system is better: only the sum protruding above a threshold is taxed at the higher rate (as with income tax).

Recent changes to stamp duty may also have a modest positive effect on demand, especially in the South of England and Scotland,

says Gardner.

He highlights the fact that the majority of the people set to gain will be in the south of England, where prices are typically higher:

The benefits will be greatest in the south of England where average house prices are higher. We estimate that around 85 per cent of transactions in London, the south-west and south-east would benefit from the changes, compared with around 50 per cent in the north, Yorkshire and Humberside, and the north-west of England.