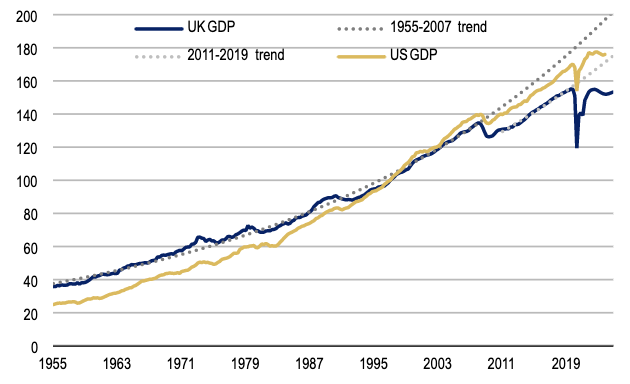

UK economy misses out on 24 per cent growth after financial and Covid-19 crises

The UK economy would be 24 per cent bigger had the global financial and Covid-19 crises not happened, a Wall Street bank has said.

“A series of unfortunate events and policy choices have cut UK potential growth” over the last decade or so, Bank of America said in a note to clients.

Since the financial crisis in 2008, Britain has undergone a sharp slowdown in economic growth, mainly driven by awful productivity improvements.

This has left households struggling to absorb the current cost of living crisis, with their capacity to maintain spending squeezed by inflation reaching a 40-year high of 10.1 per cent and years of slow pay growth.

UK trend growth slowed after the financial crisis

Sluggish GDP expansion has also partly contributed to the UK taking on vast sums of debt to finance government spending, burning a big hole in the public finances since the financial crisis. This trend was accelerated by the pandemic.

Chancellor Jeremy Hunt and prime minister Rishi Sunak are expected to launch £55bn of spending cuts and tax hikes next Thursday to ensure they meet their financial goals of reducing debt as a share of the economy and not borrowing to fund day-to-day government spending in three years.