UK banks have swerved bonus cap by hiking pay, BoE finds

UK lenders have raised staff pay to compensate for smaller hand outs after the banker bonus cap was implemented following the financial crisis, new research out today has found.

The City’s top bankers’ pay has been steadily rising since the rules were imposed in 2014, according to the Bank of England.

“The bonus cap [has led] to a substitution from bonuses to fixed pay [that] has persisted in the years after the bonus cap was introduced,” a staff paper has found.

A cap on bonuses as a share of fixed pay was levied on UK banks to prevent mistakes that led to the 2008 financial crisis from happening again.

A greater chunk of handouts consisted of giving staff shares in their banks to reduce excessive risk taking behaviour that nearly toppled the global banking system.

Under the regime, created by Brussels and London, staff payouts could also be deferred for several years with the intention of increasing staff “exposure to banks’ long-term risks and align incentives better,” the Bank of England said.

“By exposing bankers to the longer-term outcomes of their decisions or bank performance, deferral rules aim to prevent short termist behaviours and excessive risk-taking, contributing to greater financial stability,” the central bank added.

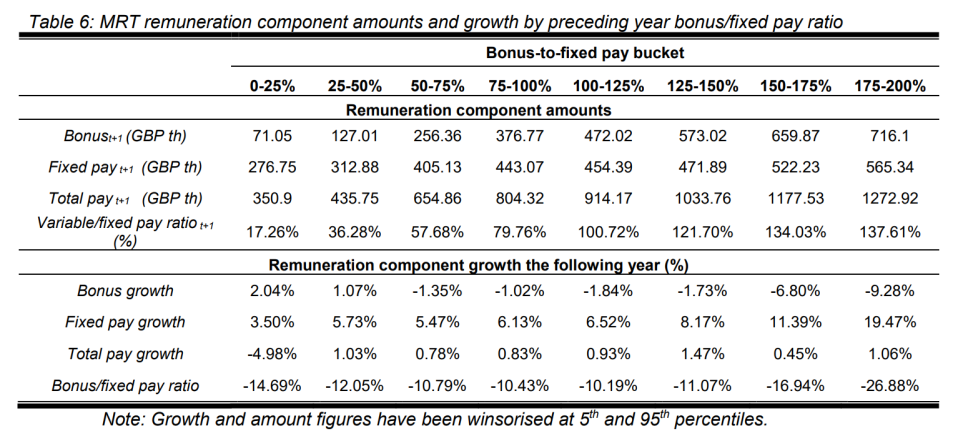

However, critics of the rules have claimed lenders have avoided them by using money they would have otherwise handed out to bankers via bonuses to hike basic pay. The Bank’s research came to that conclusion.

Banks have been raising fixed pay after bonus cap implementation

“We find some evidence that confirms theoretical predictions that restrictions on the maximum variable-to-fixed remuneration ratio potentially resulted in higher fixed pay, and that longer deferral periods could have resulted in higher remuneration of the affected individuals,” the paper said.

Bonuses are often used in the City to reward the best bankers, fund managers and brokers without baking in higher wage costs over the long run.

Critics argue it can incentivise individuals to take actions to pump a firm’s short term performance, but damage it in the long run, to bag a larger bonus.

In last month’s autumn statement, chancellor Jeremy Hunt confirmed the government is scrapping the bonus cap.

The Bank today said it is now consulting the City over how best to reshape the bonus regime after the cap is ditched.