The end of the bear? This time is different

The metaverse is the one of the most risk-on categories thus explains its steep fall from peak in terms of the valuations driving NFTs, digital land, DeFi, and cryptocurrencies, among other forms of utility. Everyone wants to know when the bear market will be over or if the current bounce spells the end of the bear market.

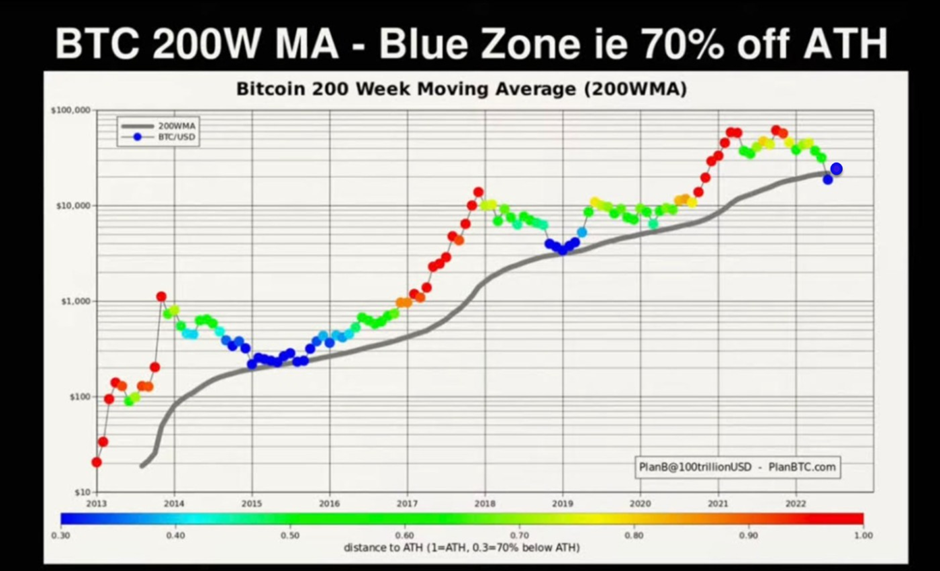

The saying, “This time is different” has been overused but in the case of this bear market, this time is actually different. Just because Bitcoin was at or below major points of support does not mean it has to get support or have a quick recovery. Many thought Bitcoin could never go below 20,000 because it had never traded below prior bull market highs. The statistical problem is there are only three occurrences of this since 2011 so is not statistically significant despite Bitcoin trading just above its 200-week moving average as of this writing. Plus the macro backdrop is the most dreadful it has been since Bitcoin was created.

When will the Fed halt hikes?

Many are wondering when the Fed will indicate they are halting rate hikes or launching QE5. The price of oil has come well off its peak which can temper CPI, but core inflation is also a real issue. Neither form of CPI inflation is anywhere near the Fed’s target 2% rate. Since rate hikes take time to affect the economy, the worst of the recession may not be felt until mid-2023. CME Fed Futures predict 3 more rate hikes for this year of 75, 25, and 25 bps which would bring the FFR to 350-375. But with debt at record levels, rates cannot get to the Fed’s targeted 3.6% without greatly upsetting markets due to the debt service which impacts GDP.

Back in 2018, as the Fed continued to hike rates, markets finally started into a sharp downtrend in late 2018 culminating in the first Xmas crash on Dec 24, normally a sleepy and mildly bullish trading day. The Fed chair immediately went live telling markets what they wanted to hear- that balance sheet tightening would be put on hold. That was the major low for both stocks and Bitcoin. I believe we will see a rhyme of what happened in 2018 later this year given that central banks remain in a tightening phase. The Bank of England raised rates by 50bps to 1.75% the other day, the largest increase since 1995. The BoE predicts its CPI inflation to peak at over 13% by October.

That said, over in the U.S., M2 has been sideways all year which explains the bear markets in both stocks and cryptocurrencies.

The inflation megatrend

The idea that the Fed can materially reduce M2 when debt is this large goes against hundreds of years of market cycles. The U.S. has already crossed beyond the point of no return. M2 will continue to accelerate from here, eventually resulting in a potentially global hyperinflationary scenario. The inflation megatrend is here to stay. Ultimately, the Fed will have to halt the hikes or crash the markets. Eventually, QE5 will launch due to a new crisis or some nonsense political package such as the Inflation Reduction Act which actually increases debt in the long term as it subsidizes uneconomic clean energy and clean agriculture spurring inflation while increasing taxes on individuals and corporations which further drives innovation overseas. The act also doubles the size of the IRS as 87,000 new tax agents will be hired to handle 1.2 million new audits a year with the majority targeting those who earn under $75k/year. Uncle Sam is getting even more ornery in his old age as the government is broke and couch diving for change.

Triple whammy: Record debt, soaring inflation, interest rates near the floor

The macro economic situation today is far worse than in prior cycles. This is what most do not understand. Instead, many cling to the hope that they might recover part of their huge losses by HODLing. Many use Plan B’s chart shown above to justify why Bitcoin has found a major low. Plan B on Twitter has a wide following. He uses the stock-to-flow model to chart the price of Bitcoin. It has worked very well over the years, but all models can be strained to breaking when conditions change.

Crypto has never been through a prolonged recession. The last one was in 2008 before Bitcoin came into being. The one in Mar-2020 was extremely short-lived because the Fed chair pumped massive sums into the system via QE.

The upshot is Bitcoin and stocks can fall a lot lower than current levels given that the Fed will likely continue to hike until stock markets start into accelerated downtrends. This will affect metaverse valuations to a far greater degree. Using the rationale that Bitcoin has already fallen 75% so, “How much further can it fall?” can lead to huge sums lost. In 2014 and 2018, it fell -87.5% and -84%, respectively. If Bitcoin were to fall again to such levels, it would represent another -50% drop from -75% ($69,000 x 0.25 = $17,250) if it fell to -87.5% off peak ($69,000 x 0.125 = $8,625), not 87.5%-75%= 12.5%. #avoidbadmath

Macro rules all: “Don’t fight the fed”

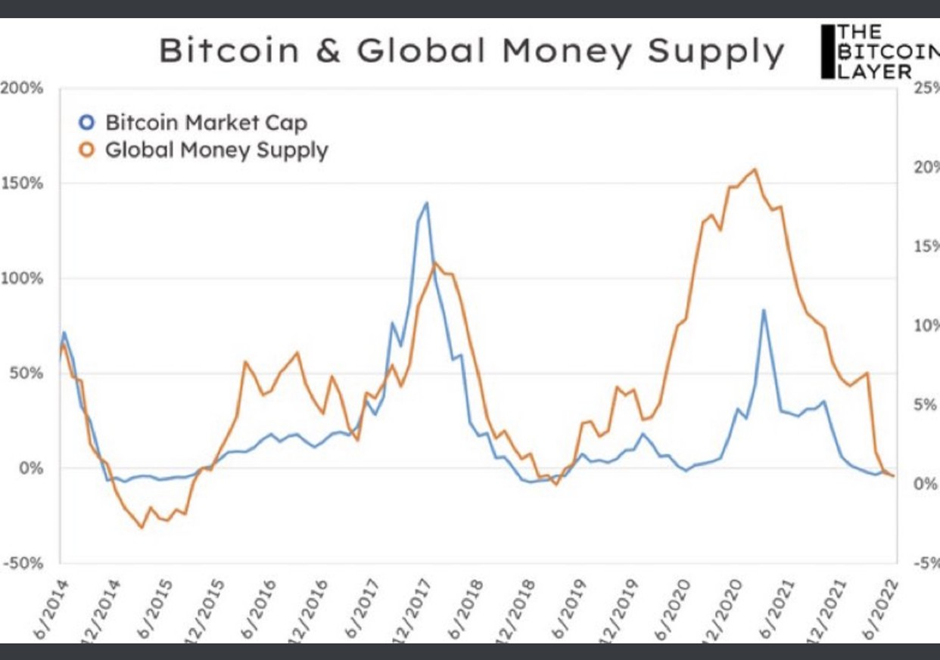

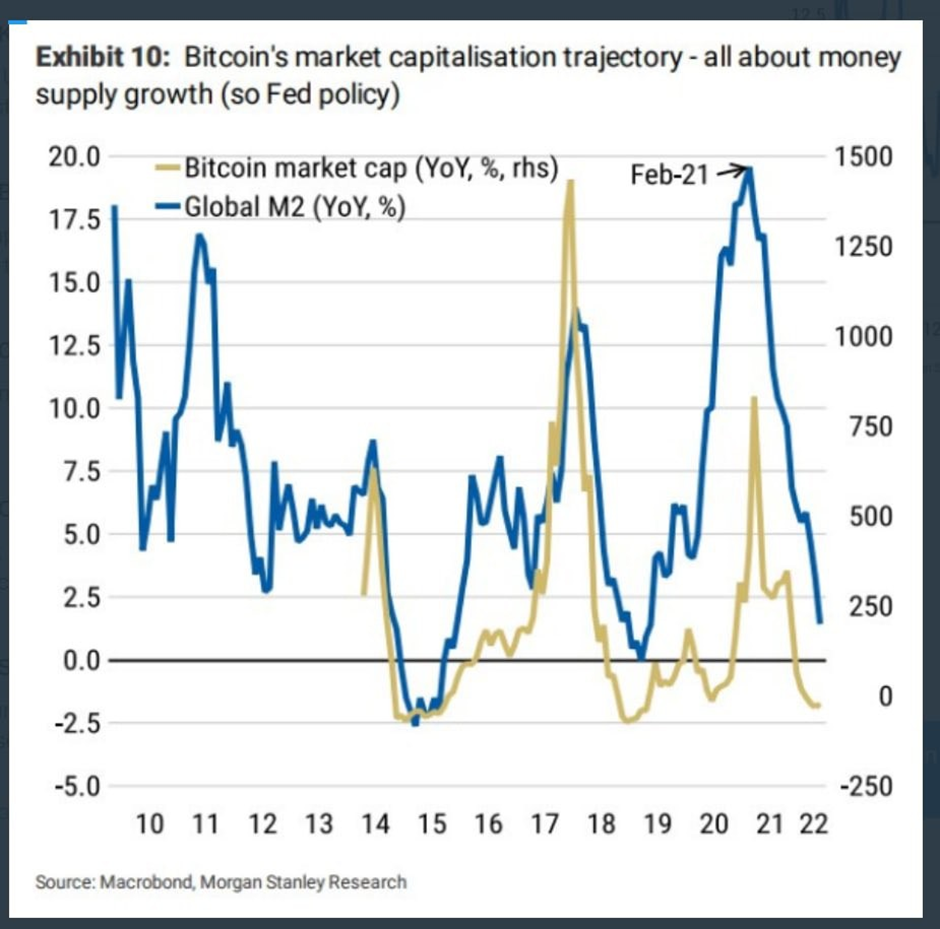

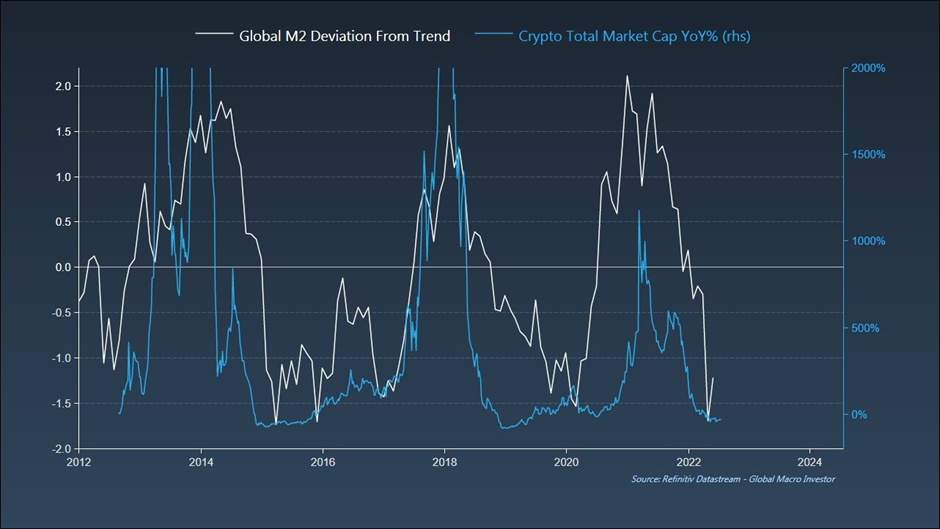

Macro is the driving force behind the value of cryptocurrencies. Bitcoin is a hedge against monetary debasement. When you track the year-over-year change in global money supply, you see the YoY change in market cap of Bitcoin corresponds almost perfectly. Global M2 tanked in 2014, bottoming in early 2015. Bitcoin the same. Global M2 peaked in late-2017, tanked in 2018, bottomed in early 2019. Bitcoin nearly the same where its bottom came in Dec-2018. In the most recent cycle, global M2 peaked in Apr-2021 and is currently tracing out lower lows. Bitcoin correlated strongly where it peaked in Apr-2021 at around $65k but then had a few months struggle higher on unconvincing volume to $69k in Nov-2021 before falling -74.5% peak-to-trough.

The fact of the matter is that global M2 is still shrinking given rate hikes in the U.S. and abroad. If other major banks start to halt their hikes later this year, that could be a bottoming sign for Bitcoin as data shows it can bottom a few months before global M2 bottoms.

Here’s another chart on Bitcoin market cap vs. global M2:

And here’s a chart of the crypto market cap vs. global M2:

Know that dead bat bounces can go higher than most anyone expects. In 2000 and 2008, stock markets bounced up to their respective 200dmas before rolling over again then plumbing to new depths. Major averages still have a ways to go to bounce up to their 200dmas but because the macro situation is historically one of the weakest, they may roll over to retest then plumb new lows before they bounce to those higher levels. Carpe diem!

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, PhD nuclear physics UC Berkeley/record breaking KPMG audited accts in stocks & crypto/bestselling author/top 40 charted musician/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr Kacher bought his first Bitcoin at just over $10 in January-2013 and contributed to early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in Bitcoin since 2011 to within a few weeks. He was up in 2018 vs the avg performing crypto hedge fund (-54%) [PwC] and is up well ahead of Bitcoin & alt coins over the cycles as capital is force fed into the top performing alt coins while weaker ones are sold.

Website 1 of 4: Virtue of Selfish Investing Crypto Reports

LinkedIn: https://www.linkedin.com/in/chriskacher/

Company 1 of 3: TriQuantum Technologies: Hanse Digital Access

Twitter1: https://twitter.com/VSInvesting/

Twitter2: https://twitter.com/HanseCoin

Encyclopedia1: https://de.wikipedia.org/wiki/Chris_Kacher

Encyclopedia2: https://everipedia.org/wiki/lang_en/Chris_Kacher

Author: https://www.amazon.com/author/chriskacher

Composer: https://music.apple.com/us/album/teardrop-rain/334012790

Youtube: https://www.youtube.com/user/teardropofficial

Interviews & Articles: https://www.virtueofselfishinvesting.com/news