Structural hedges: Banks’ secret weapon to capitalise on high interest rates

The UK’s major listed banks are set to reap the benefits of higher interest rates for years to come thanks to the impact of structural hedging, according to analysts.

Over the past few weeks, high street banks have reported that the need to offer savers better rates and an increasingly competitive lending market has eaten into their margins. And investors have expressed concern that the tailwind from higher rates is coming to an end.

But analysts told City A.M. that structural hedging will mean lenders will see continued benefits over the coming years.

Structural hedging is a risk management tool used by banks to reduce the sensitivity of earnings to interest rate shocks. Banks use some assets to build a fixed-income cash flow that protects overall earnings from interest rate volatility.

Currently those assets, which were invested when interest rates were lower, sit in low-yielding products. However, Hargreaves Lansdown analyst Matt Britzman told City A.M. that as “contracts mature, and balances get reinvested at higher rates, the income received moves higher”.

“It’s expected to take several years for the hedge to fully move off those old, low, rates – so the benefits will be spread over that period. Of course, should rates change materially from where they are now – that picture could change.”

While this means earnings have been held back by the hedge over the short term, the hedge will be an increasing tailwind going forward as assets can be reinvested into higher-yielding products.

“Over the next few years, as the hedge rolls on to new contracts, that drag starts to fade away and banks can start to reap the full benefits of the higher rate environment,” Britzman said.

Tomasz Noetzel, a Bloomberg Intelligence analyst, told City A.M. structural hedges would be “critical tailwinds for UK banks net interest income generation in 2024-25”.

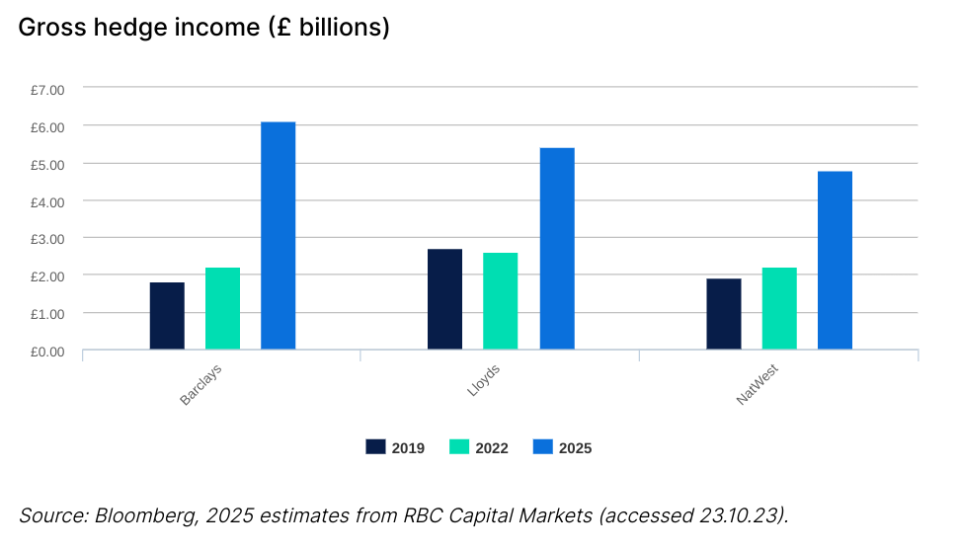

Britain’s top three lenders – Barclays, Lloyds and Natwest – each recorded gross hedge incomes of more than £2bn in 2022 and are expected to more than double these amounts by 2025.

RBC analyst Benjamin Toms predicted that structural hedges’ would go from making up around 20 per cent of banks’ net interest income in 2023 to approximately 50 per cent by 2025.

He expected this tailwind to boost banks’ net interest income by 34 per cent by 2025, relative to 2022.

“Although the benefit may not be fully visible until H2’24, because of offsetting headwinds in H1, we continue to believe that the magnitude and duration of structural hedge tailwinds are underappreciated by the market,” Toms told City A.M.