Steer clear of Defi?

I personally am steering clear of the yield farming space completely until it settles down into something more sustainable. You have been warned.

These are not my words but the words of an influential voice in the crypto world, Vitalik Buterin himself, broadcast to the world in a recent tweet. Whether you share his view or not may have something to do with your appetite for yield and the risk that ineluctably goes along with it. The term farming evokes bucolic images that may overshadow the risks that decentralised finance contracts involve.

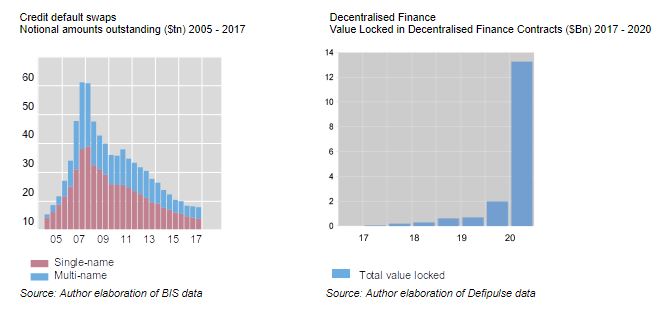

Innovation in financial markets is no stranger to turbulence: the appetite for Credit Default Swaps (“CDS”) – a new instrument introduced in 1994 by JP Morgan – grew in the early 2000s to reach its peak in 2007, when the notional outstanding stood at over $64tn – as observed by BIS in a recent paper (“The credit default swap market: what a difference a decade makes”; Iñaki Aldasoro, Torsten Ehlers; BIS Quarterly Review, June 2018).

The rate of growth of decentralised finance markets is unprecedented; of course, it is still orders of magnitude smaller than the CDS global market and its size keeps it below the radar of regulators – for now.

It is evident that decentralised finance markets are showing some distortions, just like credit markets did prior to collapsing when for some companies the annual cost of buying credit protection had fallen below the risk premium, effectively generating nearly risk-free returns. Nearly, as CDS investors realised when at the height of the 2008 financial crisis, CDS turned into claims on a plethora of insolvent sellers of credit risk protection.

Returns offered by decentralised finance contracts should price in the risks that these new instruments expose investors to; operational risk and market conduct risk appear to be the key drivers, though methodologies for their quantification are far from developed. Within operational risk, I would include issues ranging from simple software bugs like the one that killed the Dao in 2016 or just a few weeks ago Yam, and fraud and hacks that are perpetrated in the digital assets world. Within conduct risk, I would include the issues of so-called whales, investors that have accumulated substantial holdings of tokens sufficient to manipulate the market.

Compound, for example – a popular market for digital assets credit – is generally referred to as a low-risk investment and yet, even with low volatile assets such as stablecoins, double digits returns have been the norm in the last months.

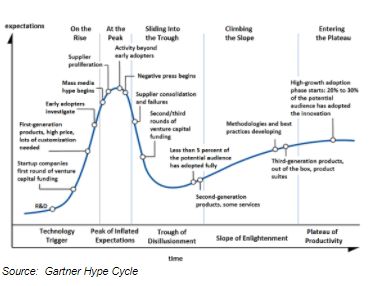

To paraphrase Buterin’s words, decentralised finance is probably not yet through the all painful phases of the hype cycle.

Another key risk that preoccupies some is money laundering. A smart contract is ultimately an algorithm that, unlike traditional intermediaries, does not insist on ascertaining the source of funds and the identity of investors. Will decentralised finance become the hotspot for money laundering?

Does, for example, Uniswap – a protocol for creating markets of ERC20 tokens – provide an efficient vehicle to transmit value anonymously? An astute criminal would probably find ways to exploit decentralised markets with no more effort compared to that required to exploit formal financial markets. Valuable assets have long been exploited by criminals to launder the proceeds of crime, yet controlling every single human activity where value is exchanged is impractical, if not impossible. There is also a clear trade-off between protecting privacy and fighting money laundering and tax evasion: physical cash is the pre-eminent evidence of it.

The Financial Action Task Force (FATF) – a global organisation aimed at protecting the global financial system against money laundering and terrorist financing – is well aware of the role that gold, among other non-financial assets, plays in criminal activity. Gold, or better, diamonds – as a wealth-management once confessed to US authorities – is an efficient store of value that can be transported with ease and concealed when needed. Yet the transfer of its value into the formal financial system is still subject to the controls that governments impose on financial intermediaries.

Cryptoassets, the commodities exchanged in decentralised finance markets, present similar challenges in relation to formal financial systems, and an additional burden: the information carried in perpetuity about their previous owner.

A challenge clearly exists with assets that cut across the formal financial sector and decentralised finance markets. Stablecoins, in particular, have seen steady growth since 2017, with their trading volume surpassing that of Bitcoin. Last June the FATF released a “Report to G20 on so-called Stablecoins”. The title of the report provides a clue of the key issue that exists around stablecoins, a commonly agreed definition and exact classification of the different types available to investors.

The FATF together with several regulators around the globe have understandably expressed concerns on global stablecoins with potential mass adoption, preoccupied in particular by the Libra project. Yet it is possible to design stablecoins that are issued by regulated financial intermediaries that not only address the regulatory concern but provide a transparent means of payments to improve efficiency and reduce money laundering risks. Regulated stablecoins are a key enabler that decentralised finance markets require to mature.

Francesco Roda, CRO of Koine, an institutional post-trade service provider for digital assets. For further information please visit https://www.koine.com

Crypto AM: Technically Speaking in association with Zumo Money