Square Mile’s job market shrinks as firms cut costs

New data has shown job openings and jobseekers in the City’s financial services sector have fallen for the second consecutive quarter as firms respond to high costs and post-pandemic overhiring.

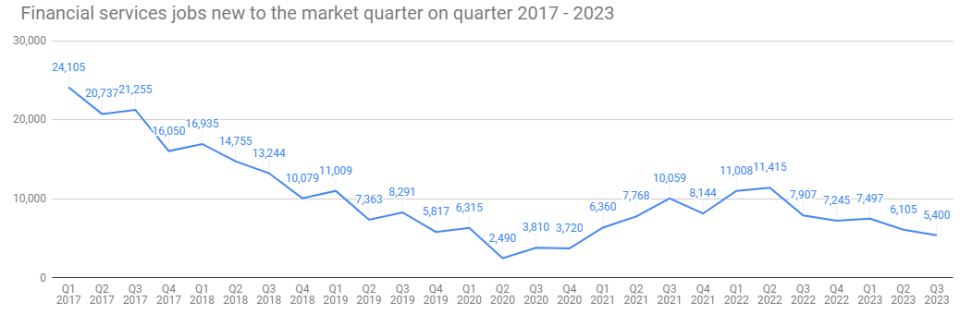

The third quarter saw a 31 per cent fall in jobs available compared to the same period last year, according to recruiter Morgan McKinley’s London employment monitor.

Meanwhile, the number of financial professionals looking for a job in the City decreased by 34 per cent to its lowest level since before the Covid-19 pandemic.

London typically sees a fall in job openings during the summer months as companies scale back hiring efforts and employers exercise caution over the economy.

Post-pandemic overhiring and high interest rates have pressured businesses to reduce costs, with major firms planning job cuts in recent months amid a slowdown in demand for services like dealmaking and investment banking.

“The summer season, when many professionals take breaks, coupled with long job searches and unsettled economic conditions, has dented candidate confidence to actively pursue new opportunities,” said Hakan Enver, managing director of Morgan McKinley UK.

“This is no surprise given the aggressive hiring post pandemic, which led to a resilient workforce. Many firms ended up with too many people and spiralling salaries caused falling staff attrition rates and reduced demand with lots of underutilised employees.”

Workers who managed to move from one firm to another received an average pay rise of 20 per cent, up seven per cent from last quarter.

“This highlights that financial services firms are still prepared to offer the right salaries in a very tight and candidate short market,” Enver said.

He added that businesses that have scaled back hiring in response to economic uncertainty “are likely to find solace in the declining inflation and the belief that interest rates have now reached their peak”.