Some inconvenient truths about income

“Chin up. Be positive. It’ll all work out.” We are always being encouraged to look on the bright side, but too much optimism can be dangerous.

Take the simple matter of how much we expect to earn from our savings and investments. Far too many people around the globe take a “glass half full” approach to future returns that simply does not match reality.

The truth is, we live in a world where record low interest rates and years of asset purchases by central banks have led to record low bond yields. That means that when we put money away in the lower-risk investments and savings accounts that helped the previous generation save for retirement, the returns we are seeing are simply not enough to grow our money.

This situation seems unlikely to change any time soon. Even central banks that had been raising interest rates, like the US Federal Reserve, have changed tack this year and are now cutting rates again.

Despite this, when Schroders surveyed 30,000 people worldwide, we found that irrational optimism is rising. Average expectations of annual investment returns over the next five years now stand at 10.7% – nearly one percentage point higher than at the same time the year before.

This optimism is mirrored the world over: investors in the Americas anticipate annual returns of 12.4%; in Asia they expect 11.5% and in Europe the expectation is for 9% annual returns over the next five years.

- Read more about the Global Investor Study here

Financial advisers might dream of such returns, but they certainly wouldn’t dare to predict them. So why do savers and investors believe returns will be so high? And, more importantly, why does it matter?

The problem of recent history

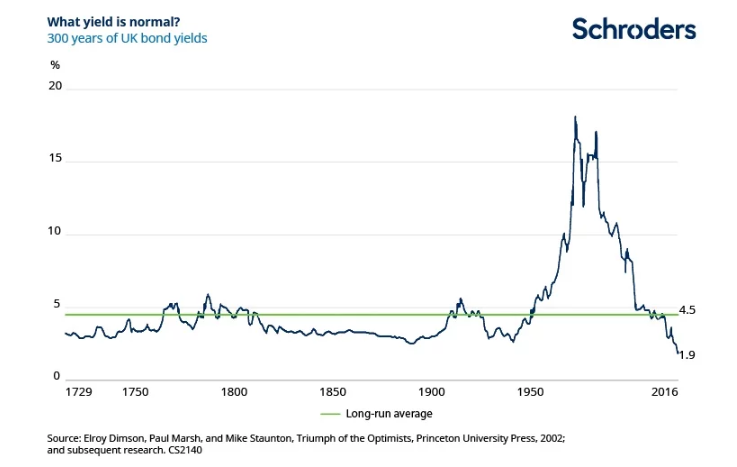

It’s often said that investors have short memories and our study confirms this. Specifically, investors and savers around the globe seem able to remember only back to the 1970s, 1980s and 1990s, when interest rates and bond yields looked very different to how they are now.

Those were the days when my father could put money into an National Savings & Investment bond, backed by the British government, and gain a 15% risk-free return. Savers in many countries could live off the income from their savings accounts.

These double-digit returns for savers have become stuck in our memories. However, they were the exception, not the rule. Across a broader sweep of history, bond yields have stayed far closer to where we are today, as the chart below shows. Returns for savers were correspondingly lower too.

The first inconvenient truth is this: high interest rates were a historic anomaly – they will not return soon.

More unpalatable facts

Further truths about the future of the global economy support our view that the returns investors expect will be hard to achieve. The global labour force is declining, thanks to lower fertility rates, and this will contribute to slowing growth. Productivity growth is also expected to slow, even in emerging markets. The era of “catch up” growth as they closed the gap with the developed world is ending.

Then there’s the ageing population, a much-discussed problem that will put pressure on government finances worldwide and compound the effects of slower population growth.

Discover more:

– Investors forecast returns of 10.7% – millennials expect more

– The death of yields in six charts

– Why Europe is fertile hunting ground for income-seeking investors

Across the world, the picture for growth is gloomy. Every economically important region is expected to experience lower GDP growth over the next ten years than the average since 1996. Emerging markets will increase their share of global GDP, with China becoming particularly critical to the world economy. But even the Chinese tiger faces threats. Its policymakers will have to deal with its own demographic changes for its economy to flourish.

Finally, inflation, which could drive investment returns, is expected to be muted by decreased demand and the deflationary impact of new technology.

The net result of all of this will be a low return, low interest rate environment that looks very different from the 10.7% returns over-exuberant investors expect.

Solutions for a half-empty glass

Why am I telling you your glass is half empty? Because having unrealistic expectations does nobody any favours, especially now that so many of us are being asked to put our own financial plans in place to fund our old age.

Accepting that we have entered a low and slow income environment is the first step. Not only do you have something to plan for, you also have choices about how to tackle the gap between those expected high returns and the probable lower reality.

One obvious step that can be taken is to invest more, and to invest sooner. The miracle of compounding will then ensure the possibility of greater returns over the long run. If you can put more money away now, it will make a big difference.

Another solution is to step up the risk you take. Higher risk equities may produce higher returns, but you must be comfortable with your level of risk and understand the potential volatility this may cause along the way.

And in a low-income environment, skilled active managers can really make a difference. Diversified funds, picked by those who understand the global economic realities we face, can ensure that your money works as hard as possible for you while it is invested. Pick a fund that works for you. Then your glass really could be (more than) half full.

- Click here for more Income insights

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.