SocGen’s Albert Edwards thinks it’s 1997 all over again for emerging markets

Societe Generale's uber-bear is at it again.

After the turmoil in emerging markets over the past few weeks, Albert Edwards thinks the unravelling has been "the final tweet of the canary in the coal mine".

He thinks the warnings are being ignored, and that the ongoing "debacle will be less contained than sub-prime ultimately proved to be."

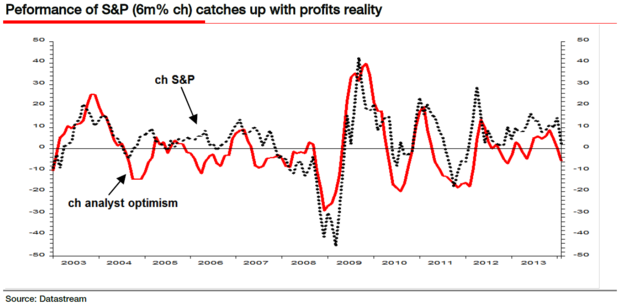

In the US Edwards points to S&P weakness reflecting worries about the outlook for US profitability.

Edwards says that the "dire profits situation will only get worse as EM implodes and waves of deflation flow from Asia."

Then we should see "the fragile situation in the US and Europe" overwhelmed, says Edwards.

Now Edwards thinks that even if the Federal Reserve "resumes massive QE" as the "world melts down", that things still won't perk up:

They will instead find themselves locked into a Freddie Kruger-like nightmare in which phase 3 of this secular bear market takes equity valuations down to levels not seen for a generation.

Putting the emerging market "crisis" in perspective, things don't look that bad – and plenty of City firms agree that talk of crisis has been overstated.